Why Case Design?

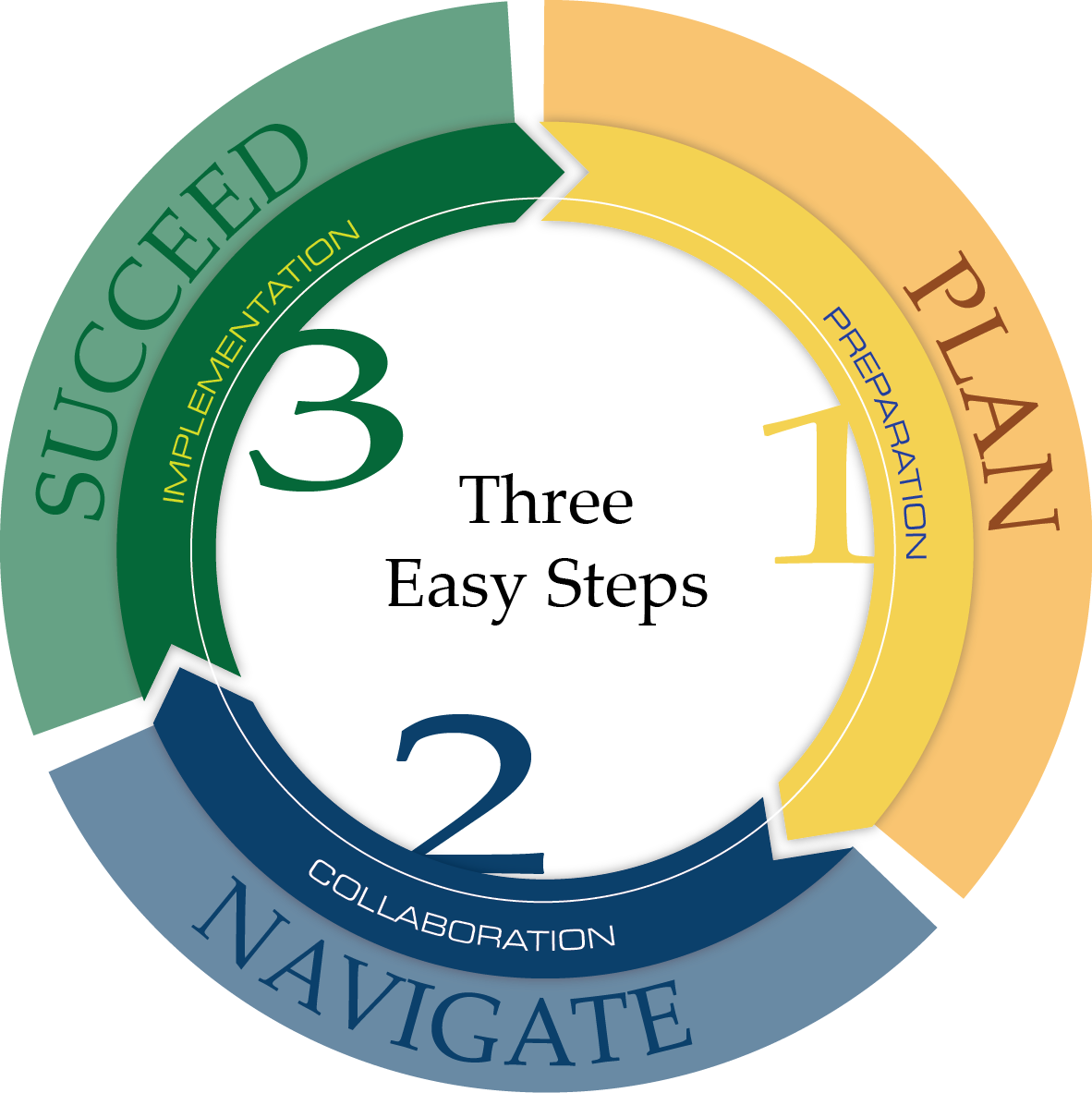

The purpose of case design is to encourage collaboration between client, advisor and asset manager to ensure that the client’s investment plan fully supports their overall financial plan.

When you engage in the case design process, you can feel confident that your investment recommendations are aligned with your client’s goals.