Navigator® Personalized UMA is available exclusively at AssetMark

Design Investment Strategies

as Unique as Your Clients

Navigator PUMA®

The Personalized UMA

Collaborative Portfolio Construction to Help You Navigate Your Clients’ Future.

Complete Personalization

A Unified Managed Account Customized for Every Client

With Navigator PUMA®, you can completely customize the allocation, helping ensure that every investor’s portfolio is comprehensively focused on their needs.

Individual Stock and Bonds

Tax Transition Strategies

Tax Loss Selling

State Tax Preference for Municipal Bonds

Covered Call Writing

Multiple Strategies in a Single Account

One Quarterly Household Statement

Regional Investment Consultant

Direct Access to Portfolio Managers

Personalized Portfolio Management:

A Client-First Approach

We believe a client-first approach to portfolio management can help clients remain committed to their investment strategies in order to reach their long-term goals. Every client is unique, and Clark Capital’s integrative process helps ensure that all of the client’s needs are addressed.

Investment Strategies

Diverse individual investment strategies to help you build the right portfolio for every client.

This is not a recommendation to buy or sell a security or to adopt a particular investment strategy.

Why Case Design?

The purpose of case design is to help clients successfully reach their goals.

Every client is unique, and Clark Capital’s collaborative process helps ensure your client’s investment plan fully supports their overall financial plan.

Clark Capital helps you navigate your clients’ financial future.

A highly collaborative and consultative process can help you provide a better client experience. We provide you with the following tools to help navigate the future for clients:

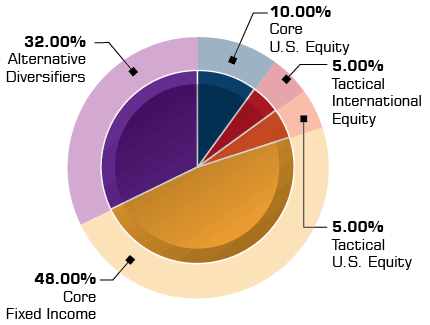

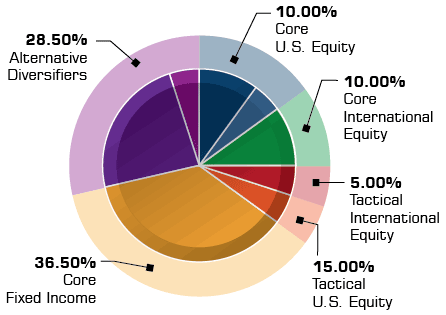

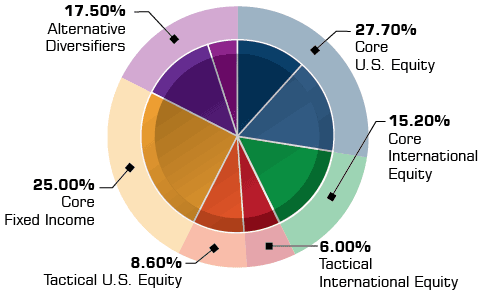

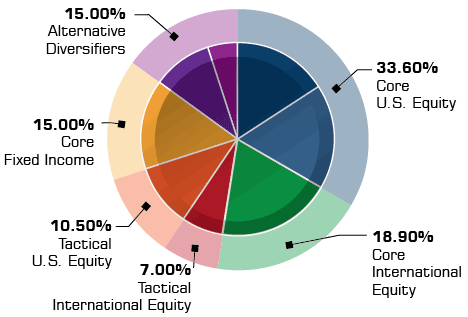

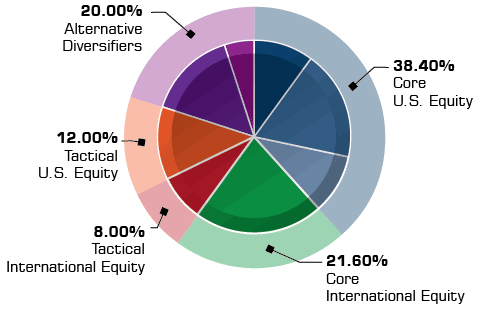

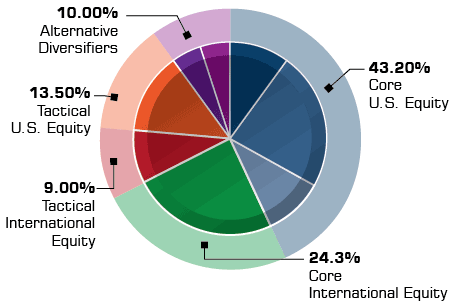

Navigator® Personalized UMA Sample Allocations

PUMA® offers a highly collaborative and consultative process that incorporates client-specific case design, personal benchmarks, income planning and more.

Profile 1 | Conservative

Profile 2 | Moderate Conservative

Profile 3 | Moderate

Profile 4 | Moderate Growth

Profile 5 | Growth

Profile 6 | Maximum Growth

This is not a recommendation to buy or sell a security or to adopt a particular investment strategy. The visuals are shown for illustrative purposes only and attributions could change significantly based on information about an investors objectives, time horizon and risk tolerance is learned. The actual characteristics with respect to any particular account will vary based on a number of factors including but not limited to: (i) the size of the account; (ii) investment restrictions applicable to the account, if any; and (iii) market exigencies at the time of investment. Clark Capital reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs. The investment strategy or strategies may not be suitable for all investors. Investors must make their own decisions based on their specific investment objectives and financial circumstances.