High Net Worth Strategies to Navigate Today’s Markets

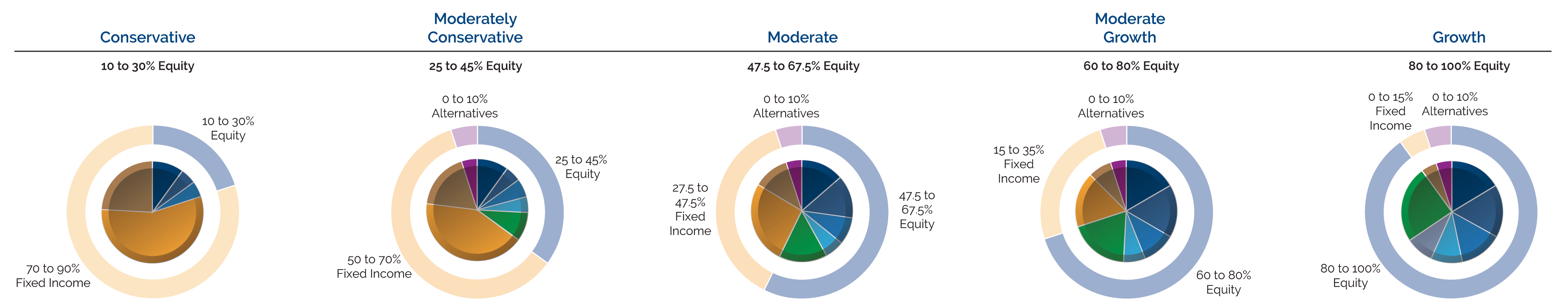

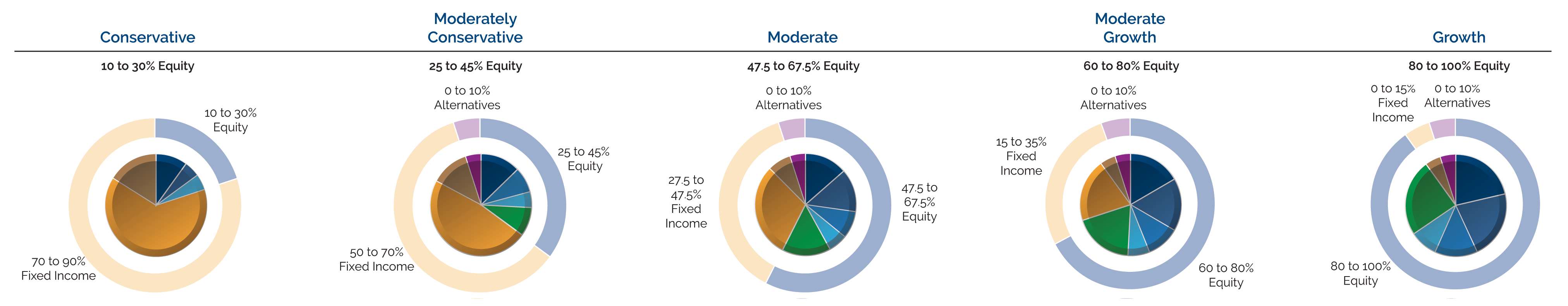

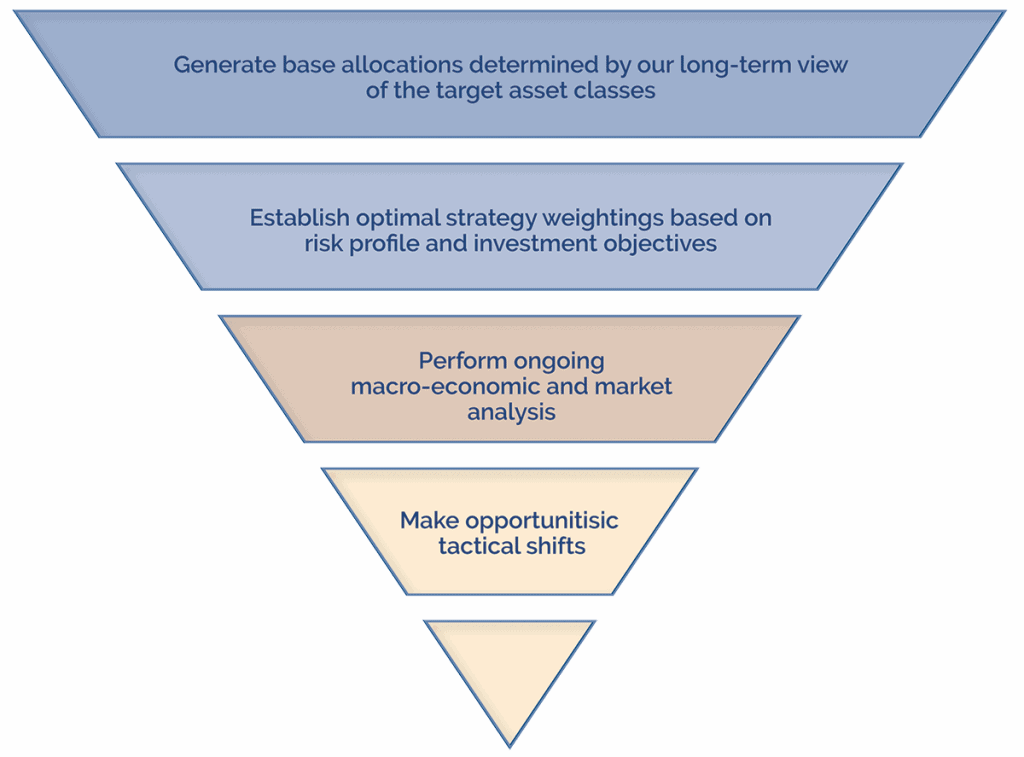

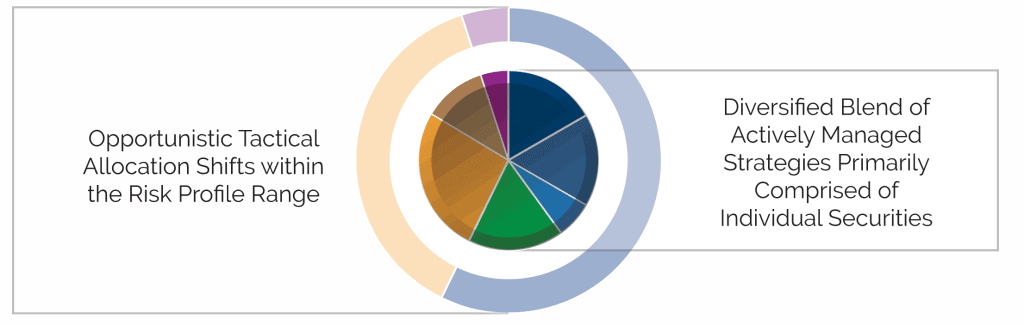

Designed to navigate changing market conditions, Navigator® Total Wealth Strategies are actively managed by our experienced team of portfolio managers. Each allocation is fully diversified, combining multiple strategies and asset classes into a single account.