“Will I have enough money to live on in retirement?”

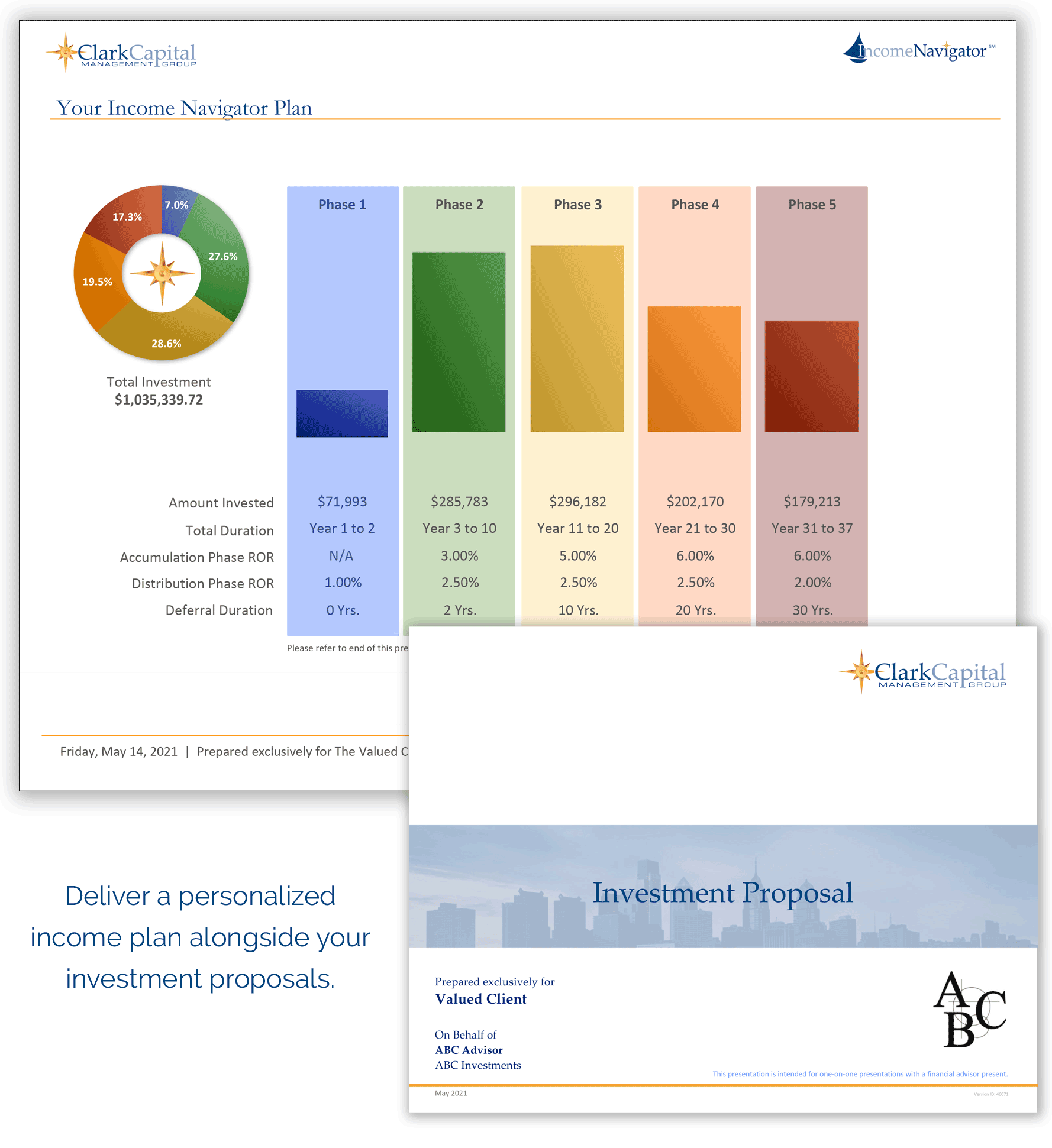

Today, people are living longer, which means they need to think long-term when planning for retirement income needs.

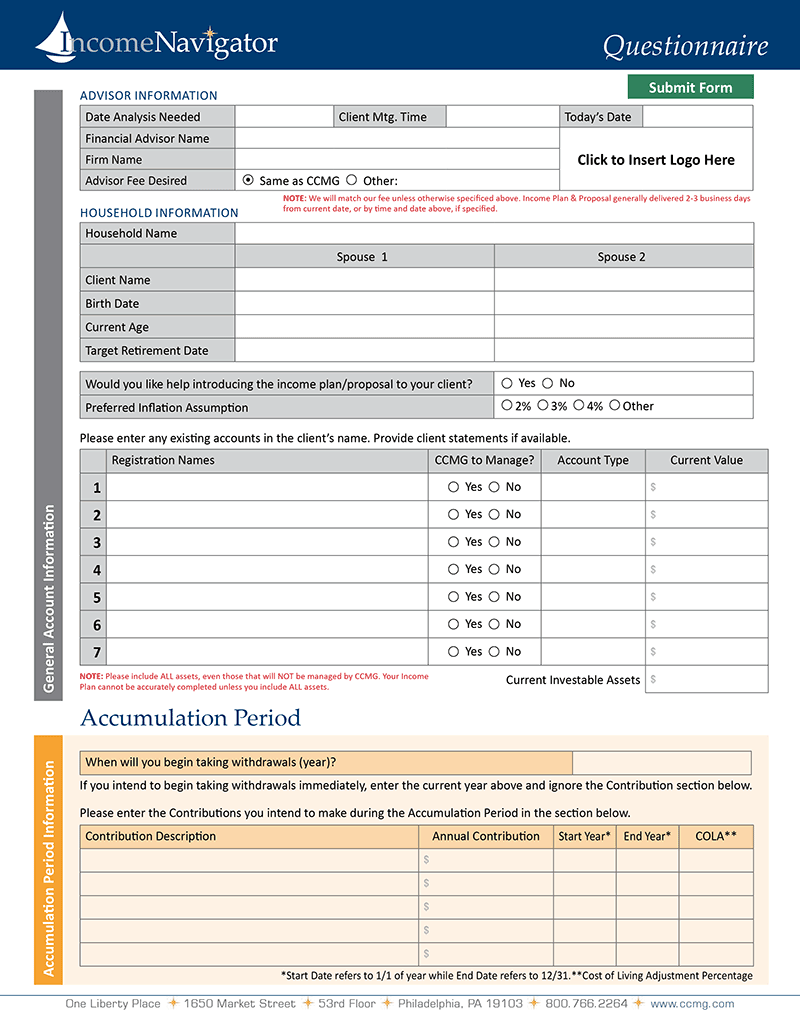

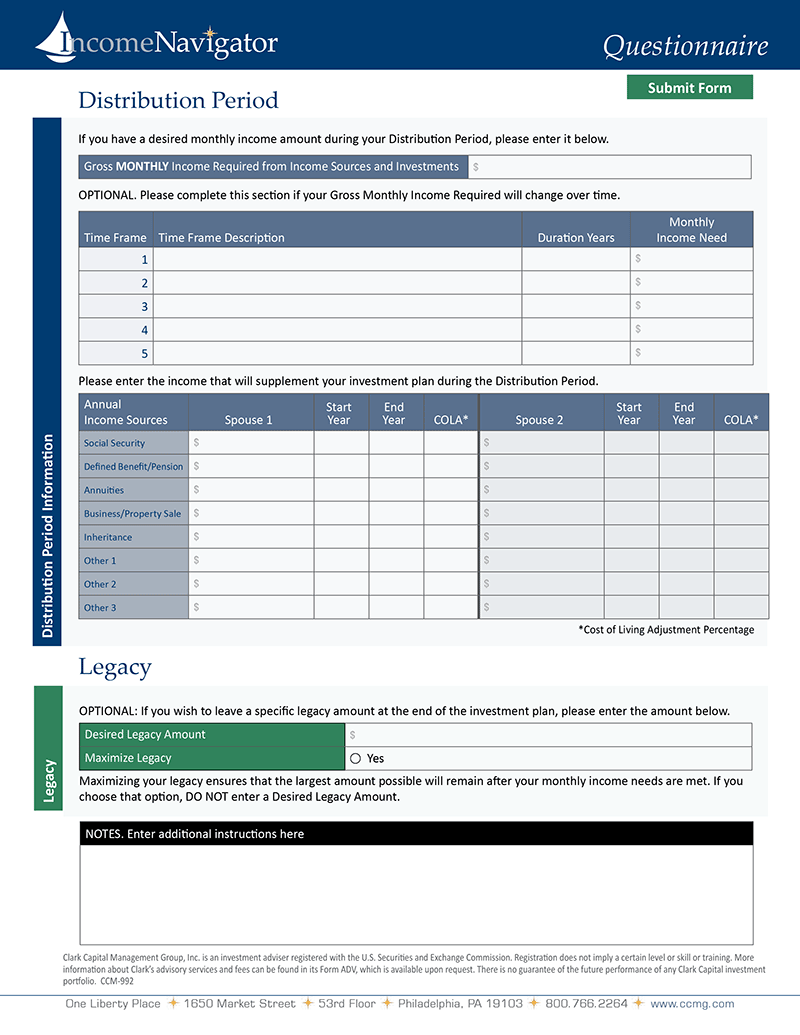

Income Navigator is designed to help investors see how the decisions they make today will impact their financial future.