Modest Gains for Stocks, Modest Declines for Bonds to Start the Year

HIGHLIGHTS:

- The solid end to 2023 for stocks continued in early 2024 as all-time highs were achieved for the S&P 500 and Dow Jones Industrial Average. After hitting prior highs at the very start of 2022, these indices – after two long years – marched to record highs once again. However, small-caps struggled to start 2024.

- Coinciding with stock prices at all-time highs, earnings are expected to hit an all-time high in 2023 once fourth quarter data is tallied for S&P 500 companies as well. Earnings are expected to grow once again in 2024 to new highs from the 2023 levels.

- Yields had a dramatic drop over the last couple of months of 2023. After touching 5% intraday in late October – the highest yield level since prior to the credit crisis in 2007 – the 10-year U.S. Treasury yield closed 2023 at 3.88%. Rates bounced up from that point in January and closed the month at 3.99%.

- The FOMC met in late January and as expected, made no change to the Fed Funds rate. However, the Fed dampened expectations of a March rate cut, which sent stocks lower on the final day of the month. The debate now is how rate cuts will unfold in 2024.

- The U.S. economy continues to be much stronger than most expected. The first look at Q4 2023 GDP was another positive surprise with an annualized growth rate of 3.3% compared to expectations of 2.0%. This growth is on the heels of Q3 growth which stood at 4.9%. The U.S. economy has been resilient.

EQUITY MARKETS

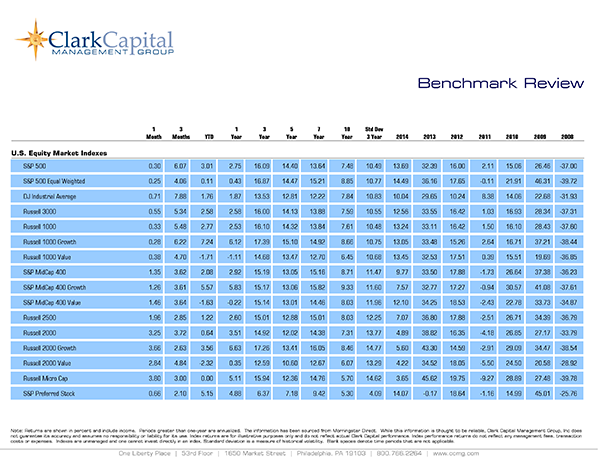

Stocks started 2024 strongly with the S&P 500 and Dow Jones Industrial Average hitting new all-time highs in January. However, some of those gains were given up at the end of the month as the Fed lowered expectations of a rate cut at the March FOMC meeting. Noteworthy, the market fell back into its recent pattern of large-cap growth outperforming most other areas of the market in January. For example, the Russell 1000 Growth Index gained 2.49% for the month, while the Russell 1000 Value Index only advanced 0.10%. The equal-weighted S&P 500 Index was down in January while the traditional market-cap weighted S&P 500 Index gained for the month. Small-caps struggled in January after enjoying a double-digit rally in December. See Table 1 for equity results for January 2024 and calendar year 2023.

Table 1

| Index | Janaury 2024 | 2023 |

|---|---|---|

| S&P 500 | 1.68% | 26.29% |

| S&P 500 Equal Weight | -0.82% | 13.87% |

| DJIA | 1.31% | 16.18% |

| Russell 3000 | 1.11% | 25.96% |

| NASDAQ Comp. | 1.04% | 44.64% |

| Russell 2000 | -3.89% | 16.93% |

| MSCI ACWI ex U.S. | -0.99% | 15.62% |

| MSCI Emerging Mkts Net | -4.64% | 9.83% |

2023 will be remembered for the dominance of large-cap growth, and 2024 started much the same way. However, the broadening in the market over the last two months of 2023 led to solid gains across the board in equity markets last year. We believe the market could continue to broaden in 2024 with valuations more compelling in small, mid-cap and international stocks.

International stocks continued to underperform U.S. equities with emerging markets among the weakest of the stock market categories to begin 2024. We still see opportunities in international markets with valuations that are lower than the U.S. and our expectation that the U.S. dollar will likely weaken over the short to intermediate-term as the Fed begins cutting rates in 2024.

Fixed Income

After struggling for much of 2023, bonds rallied in November and December to turn in solid results for the year. After peaking in late October, yields dropped sharply through year end, but that drop paused in January. It is a good reminder that yields can move quickly at times and it is important for bond investors to stay focused on their long-term goals during periods of volatility. The 10-year U.S. Treasury yield closed 2023 at 3.88% and it moved up to end January at 3.99% creating a headwind for bonds to begin the new year. See Table 2 for fixed income index returns for January 2024 and calendar year 2023.

Table 2

| Index | January 2024 | 2023 |

|---|---|---|

| Bloomberg U.S. Agg | -0.27% | 5.53% |

| Bloomberg U.S. Credit | -0.18% | 8.18% |

| Bloomberg U.S. High Yld | 0.00% | 13.44% |

| Bloomberg Muni | -0.51% | 6.40% |

| Bloomberg 30-year U.S. TSY | -2.70% | 1.93% |

| Bloomberg U.S. TSY | -0.28% | 4.05% |

The move higher in rates in January was a challenge for most bond sectors. High yield bonds were flat, while more interest rates sensitive bonds like longer-dated U.S. Treasuries came under the most pressure. We expect the 10-year U.S. Treasury yield to drift lower as we move through 2024 and believe it will be in a range between 3.25% and 4.5% during the year. As the Fed begins to cut rates in 2024, we believe this will drive down rates at the front end of the yield curve as well.

We maintain our long-standing position favoring credit versus pure rate exposure in this interest rate environment. We also believe the role bonds play in a portfolio, which is to provide stable cash flow and to help offset the volatility of stocks in the long run, has not changed. Furthermore, we believe that bond yields remain attractive even though rates have dropped from their October highs. In our opinion, having an active bond management approach makes sense in these volatile times

Economic Data and Outlook

The economic engine in the U.S. continues to fire as the first reading of Q4 GDP came in much stronger than expected. While subject to revision, the 3.3% annualized growth rate was much stronger than the 2.0% expectation and reflected continued strength from third quarter growth of 4.9%. The Atlanta Fed GDPNow estimate for first quarter growth was running at 3.0% near the end of January, but that increased to 4.2% on February 1. We do expect growth to slow in 2024 from 2023, but we also think the odds favor a soft landing and not a recession at this point. Our projection for GDP growth in 2024 is 2.25%, which is right around our long-term trend expectation.

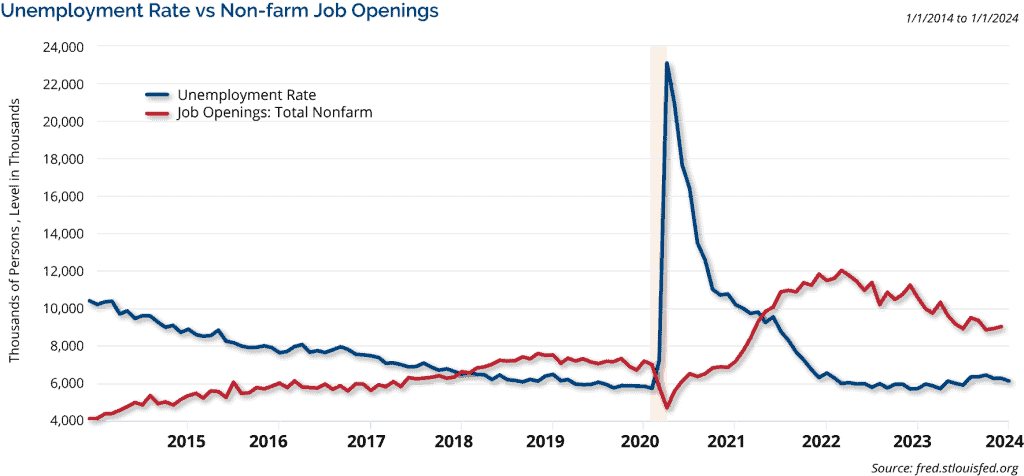

One reason we continue to expect growth in the economy comes from strength in the job market. Non-farm payroll additions were 216,000 in December, which exceeded expectations of 175,000 and surpassed the November mark of 173,000. The unemployment rate stayed at 3.7% when it was expected to tick higher to 3.8%. Average hourly earnings grew by 4.1% on an annual basis, which was higher than expectations of 3.9%. Job openings, which have been drifting lower, bounced back above the 9 million mark in December. Expectations were calling for 8.75 million compared to the prior month’s revised count of 8.925 million (original reading had been 8.79 million). The December report settled at 9.026 million job openings. We are still in a situation with millions more job openings than unemployed people in the U.S. economy. Chart 1 shows this relationship between job openings and the unemployment level. We can see this gap narrowing, but a significant gap still exists.

Chart 1

For illustrative purposes only.

With the current strength in the job market, we maintain our opinion that it seems unlikely that the economy would slow too drastically under these conditions. However, even a modest slowdown in the job market could be a headwind to economic activity due to the central role that consumer spending plays in the U.S. economy. Moving into 2024, we expect the economy will slow, but that we will likely avoid a recession. Even if a recession developed, we believe it would be mild due to the strength of the consumer. We believe opportunities exist in the stock and bond markets under either a slow growth or mild recession economic scenario.

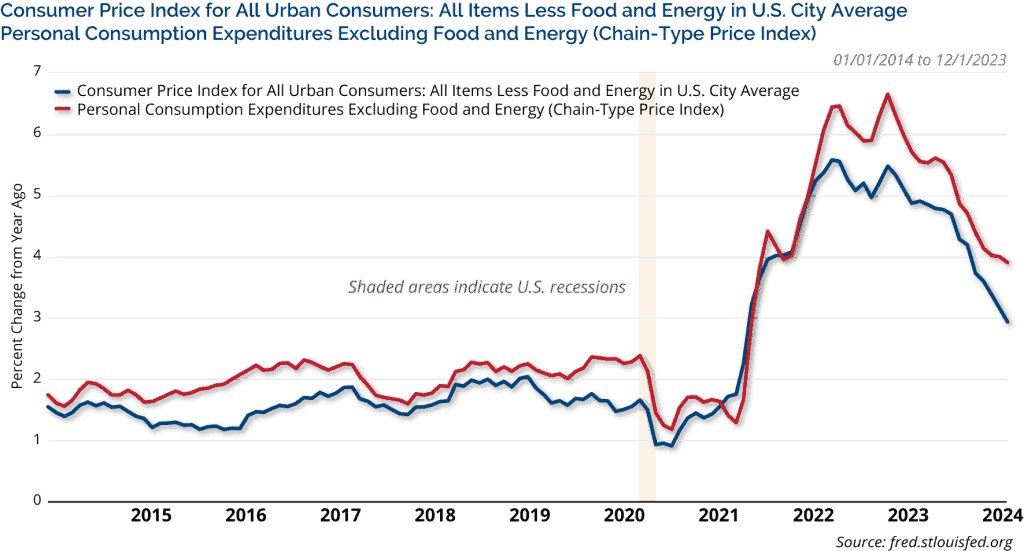

Positive inflation data seemed to be one of the primary catalysts that pushed stocks and bonds higher to close out 2023. For December (released in January), the headline Consumer Price Index (CPI) showed an annual increase of 3.4%, which was higher than expected and above the previous month. However, the core CPI was 3.9% in December for the year, which was a slight improvement from its 4% level in November, but higher than expectations of a 3.8% increase. The headline Producer Price Index (PPI) declined in December by -0.1% when it was expected to rise by 0.1%. This made the annual gain 1.0% in December, which beat expectations of 1.3%, but this was higher than the 0.8% reading from November. The core PPI had an annual increase of 1.8% in December, which was better than expected and better than the prior month’s level of 2.0%. This data continues to support the idea that inflation is headed in the right direction and the Fed will be cutting rates in 2024.

Focusing on the preferred inflation measure of the Fed, the Personal Consumption Expenditures (PCE) Index showed a 2.6% annual gain in December – same as expectations and the prior month’s level. The core PCE reading (the reading the Fed targets) was 2.9%, beating expectations of 3.0% and improving from November’s level of 3.2%. The core PCE Price Index has improved, but it remains above the Fed’s long-term target of around 2%. Chart 2 shows improvements in core consumer inflation readings the core CPI Price Index and the core PCE Price Index.

Chart 2

As the above chart shows, progress has been made on inflation. The Fed appears comfortable that no more rate increases are needed at this point and rate cuts will occur in 2024. The market, based on the fed funds futures, were anticipating the first rate cut in March. However, this changed after the FOMC meeting concluded on the last day of January. The Fed dampened hopes that a rate cut would occur in March, and market expectations now place the first cut in May. It’s important to note that this reading is very fluid, and it can and does change frequently. We expect a total of four rate cuts this year, which puts us in between the market’s expectation of around six cuts and the Fed’s “dot plot,” which is closer to three cuts.

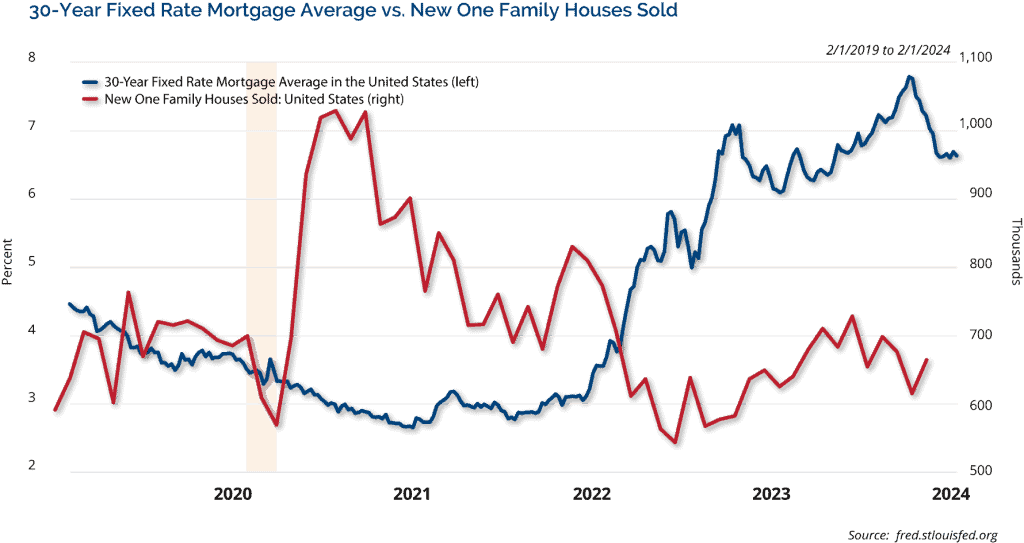

Mortgage rates remain elevated, but their recent improvement with the drop in interest rates has helped housing data. In December, building permits, housing starts, and new home sales all surpassed expectations with building permits and new home sales also improving from the prior month. Existing home sales missed expectations and had a modest drop compared to November’s levels. Home prices continue to rise in the face of low inventories. The S&P CoreLogic 20-City Index of home prices rose by 5.4% on an annual basis in November, which was below expectations of 5.8%, but ahead of the prior month’s yearly gain of 4.88%. Mortgage rates had shot higher in October and stood at multi-year highs. However, interest rates and mortgage rates dropped rather sharply in November and December. January saw relatively little change. It will be important to see how the housing market reacts moving into the new year with mortgage rates off recent multi-year highs. Chart 3 shows the relationship between mortgage rates and new home sales.

Chart 3

The ISM Manufacturing Index for December was modestly above expectations, but still marked the 14th straight month of contraction for this index. At 47.4, the index was above expectations of 47.1, which was ahead of the November level of 46.7. (While still showing contraction, the January reading for this index improved to 49.1, which surpassed expectations of 47.2. The prior month was revised lower to 47.1, matching original expectations). The ISM Non-Manufacturing Index, which covers the much larger service industries in the U.S. economy, missed expectations of 52.5 and came in at a disappointing 50.6 in December, which was a meaningful drop from the prior month’s level of 52.7. The service industries still reflected growth in December, which has helped lift the overall economy, but that growth slowed to end the year according to this measure. Recall, the dividing line between expansion and contraction for the ISM indices is 50.

The health of U.S. consumers is being highly scrutinized due to their significant role in the U.S. economy. Retail sales (ex. auto and gas) rose by 0.6% in December, which was a much stronger gain than the expected 0.3% increase. The preliminary University of Michigan Sentiment reading for January surged again to 78.8 (expectations were at 70.1) from 69.7 in December as confidence has risen meaningfully over the last couple of months. This increase in confidence is not too surprising considering the recent strength seen in the stock market and ongoing strength in the job market. The Conference Board’s Leading Index declined by only -0.1% in December compared to expectations of a -0.3% drop. For well over a year, the leading economic index has been flashing a warning sign of pending economic weakness. This has yet to materialize to any large degree, but we still monitor this data point closely.

As always, we believe it is imperative for investors to stay focused on their long-term goals and not let short-term swings in the market derail them from their longer-term objectives.

Investment Implications

Clark Capital’s Top-Down, Quantitative Strategies

After a strong 2023, the markets picked up where they left off with the New Year bringing further gains and continued momentum of risk assets. Large-cap stocks fared the best, with the S&P 500 gaining 1.68% in January and finally making a new all-time closing high on 1/19/24.

Returns were very mixed, however; large-cap growth’s dominance continued with the Russell 1000 Growth Index gaining 2.49% in January while large-cap value was flat. The Russell 2000 Index of small-cap stocks lost 3.89%. We believe credit remains firm and well bid with a solid economic backdrop.

Clark Capital’s Bottom-Up, Fundamental Strategies

The S&P 500 Index hit several record highs driven by continued strength from large-cap Technology, Healthcare, Financials, and Consumer Staples companies. Factors that contributed the most to performance included momentum, large-cap, liquidity, and profitability.

Strong Q4 2023 economic growth dampened optimism that the Fed would begin cutting rates as soon as March. Mindful of their dual continuous mandates, the Fed cooled investor sentiment at month end, essentially bringing into question the speed with which they will begin to initiate easing policy from their current neutral bias.

ECONOMIC DATA

| Event | Period | Estimate | Actual | Prior | Revised |

|---|---|---|---|---|---|

| ISM Manufacturing | Dec | 47.1 | 47.4 | 46.7 | 46.7 |

| ISM Services Index | Dec | 52.5 | 50.6 | 52.7 | 52.7 |

| Change in Nonfarm Payrolls | Dec | 175k | 216k | 199k | 173k |

| Unemployment Rate | Dec | 3.80% | 3.70% | 3.70% | — |

| Average Hourly Earnings YoY | Dec | 3.90% | 4.10% | 4.00% | — |

| JOLTS Job Openings | Dec | 8750k | 9026k | 8790k | 8925k |

| PPI Final Demand MoM | Dec | 0.10% | -0.10% | 0.00% | -0.10% |

| PPI Final Demand YoY | Dec | 1.30% | 1.00% | 0.90% | 0.80% |

| PPI Ex Food and Energy MoM | Dec | 0.20% | 0.00% | 0.00% | — |

| PPI Ex Food and Energy YoY | Dec | 2.00% | 1.80% | 2.00% | — |

| CPI MoM | Dec | 0.20% | 0.30% | 0.10% | — |

| CPI YoY | Dec | 3.20% | 3.40% | 3.10% | — |

| CPI Ex Food and Energy MoM | Dec | 0.30% | 0.30% | 0.30% | — |

| CPI Ex Food and Energy YoY | Dec | 3.80% | 3.90% | 4.00% | — |

| Retail Sales Ex Auto and Gas | Dec | 0.30% | 0.60% | 0.60% | — |

| Industrial Production MoM | Dec | -0.10% | 0.10% | 0.20% | 0.00% |

| Building Permits | Dec | 1477k | 1495k | 1460k | 1467k |

| Housing Starts | Dec | 1425k | 1460k | 1560k | 1525k |

| New Home Sales | Dec | 649k | 664k | 590k | 615k |

| Existing Home Sales | Dec | 3.83m | 3.78m | 3.82m | — |

| Leading Index | Dec | -0.30% | -0.10% | -0.50% | — |

| Durable Goods Orders | Dec P | 1.50% | 0.00% | 5.40% | 5.50% |

| GDP Annualized QoQ | 4Q A | 2.00% | 3.30% | 4.90% | — |

| U. of Mich. Sentiment | Jan P | 70.1 | 78.8 | 69.7 | — |

| Personal Income | Dec | 0.30% | 0.30% | 0.40% | — |

| Personal Spending | Dec | 0.50% | 0.70% | 0.20% | 0.40% |

| S&P CoreLogic CS 20-City YoY NSA | Nov | 5.80% | 5.40% | 4.87% | 4.88% |

Source: Bloomberg

Past performance is not indicative of future results. The opinions referenced are as of the date of publication and are subject to change due to changes in the market or economic conditions and may not necessarily come to pass. Material presented has been derived from sources considered to be reliable and has not been independently verified by us or our personnel. Nothing herein should be construed as a solicitation, recommendation or an offer to buy, sell or hold any securities, other investments or to adopt any investment strategy or strategies. Investors must make their own decisions based on their specific investment objectives and financial circumstances. Investing involves risk, including loss of principal.

Clark Capital Management Group is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training. More information about Clark Capital Management Group’s advisory services can be found in its Form ADV which is available upon request.

Fixed income securities are subject to certain risks including, but not limited to: interest rate (changes in interest rates may cause a decline in market value or an investment), credit, prepayment, call (some bonds allow the issuer to call a bond for redemption before it matures), and extension (principal repayments may not occur as quickly as anticipated, causing the expected maturity of a security to increase).

Clark Capital utilizes a proprietary investment model to assist with the construction of the strategy and to assist with making investment decisions. Investments selected using this process may perform differently than expected as a result of the factors used in the model, the weight placed on each factor, and changes from the factors’ historical trends. There is no guarantee that Clark Capital’s use of a model will result in effective investment decisions.

Non-investment-grade debt securities (high-yield/junk bonds) may be subject to greater market fluctuations, risk of default or loss of income and principal than higher-rated securities.

Foreign securities are more volatile, harder to price and less liquid than U.S. securities. They are subject to different accounting and regulatory standards and political and economic risks. These risks are enhanced in emerging market countries.

The value of investments, and the income from them, can go down as well as up and you may get back less than the amount invested.

Equity securities are subject to price fluctuation and possible loss of principal. Stock markets tend to move in cycles, with periods of rising prices and periods of falling prices. Certain investment strategies tend to increase the total risk of an investment (relative to the broader market). Strategies that concentrate their investments in limited sectors are more vulnerable to adverse market, economic, regulatory, political, or other developments affecting those sectors.

JOLTS is a monthly report by the Bureau of Labor Statistics (BLS) of the U.S. Department of Labor counting job vacancies and separations, including the number of workers voluntarily quitting employment.

The Producer Price Index (PPI) program measures the average change over time in the selling prices received by domestic producers for their output. The prices included in the PPI are from the first commercial transaction for many products and some services.

References to market or composite indices, benchmarks or other measures of relative market performance over a specified period of time (each, an “index”) are provided for your information only. Reference to an index does not imply that the portfolio will achieve returns, volatility or other results similar to that index. The composition of the index may not reflect the manner in which a portfolio is constructed in relation to expected or achieved returns, portfolio guidelines, restrictions, sectors, correlations, concentrations, volatility or tracking error targets, all of which are subject to change. Investors cannot invest directly in an index.

The Bloomberg Barclays U.S. Municipal Index covers the USD-denominated long-term tax exempt bond market. The index has four main sectors: state and local general obligation bonds, revenue bonds, insured bonds and prerefunded bonds.

The Bloomberg US Treasury Index measures US dollar-denominated, fixed-rate, nominal debt issued by the US Treasury. Treasury bills are excluded by the maturity constraint, but are part of a separate Short Treasury Index.

The Dow Jones Industrial Average indicates the value of 30 large, publicly owned companies based in the United States.

The NASDAQ Composite is a stock market index of the common stocks and similar securities listed on the NASDAQ stock market.

The S&P 500 measures the performance of the 500 leading companies in leading industries of the U.S. economy, capturing 80% of U.S. equities.

The S&P 500® Equal Weight Index (EWI) is the equal-weight version of the widely-used S&P 500. The index includes the same constituents as the capitalization weighted S&P 500, but each company in the S&P 500 EWI is allocated a fixed weight – or 0.2% of the index total at each quarterly rebalance.

The University of Michigan Consumer Sentiment Index rates the relative level of current and future economic conditions. There are two versions of this data released two weeks apart, preliminary and revised. The preliminary data tends to have a greater impact. The reading is compiled from a survey of around 500 consumers.

The Russell 1000 Growth Index measures the performance of the large-cap growth segment of the U.S. equity universe. It includes those Russell 1000 Index companies with higher price-to-book ratios and higher forecasted growth values.

The Russell 1000 Value Index measures the performance of the large-cap value segment of the U.S. equity universe. It includes those Russell 1000 Index companies with lower price-to-book ratios and lower forecasted growth values.

The Russell 2000 Index is a small-cap stock market index that represents the bottom 2,000 stocks in the Russell 3000.

The Russell 3000 Index measures the performance of the 3,000 largest U.S. companies based on total market capitalization, which represents approximately 98% of the investable U.S. equity market.

The 10 Year Treasury Rate is the yield received for investing in a US government issued treasury security that has a maturity of 10 year. The 10 year treasury yield is included on the longer end of the yield curve. Many analysts will use the 10 year yield as the “risk free” rate when valuing the markets or an individual security.

The Bloomberg Barclays U.S. Corporate High-Yield Index covers the U.S. dollar-denominated, non-investment grade, fixed-rate, taxable corporate bond market. Securities are classified as high-yield if the middle rating of Moody’s, Fitch, and S&P is Ba1/BB+/BB+ or below.

The Bloomberg Barclays U.S. Credit Index measures the investment grade, U.S. dollar denominated, fixed-rate taxable corporate and government related bond markets.

The Bloomberg Aggregate Bond Index or “the Agg” is a broad-based fixed-income index used by bond traders and the managers of mutual funds and exchange-traded funds (ETFs) as a benchmark to measure their relative performance.

The 30-Year Treasury is a U.S. Treasury debt obligation that has a maturity of 30 years. The 30-year Treasury used to be the bellwether U.S. bond but now most consider the 10-year Treasury to be the benchmark.

The ISM Non-Manufacturing Index is an index based on surveys of more than 400 non-manufacturing firms’ purchasing and supply executives, within 60 sectors across the nation, by the Institute of Supply Management (ISM). The ISM Non-Manufacturing Index tracks economic data, like the ISM Non-Manufacturing Business Activity Index. A composite diffusion index is created based on the data from these surveys, that monitors economic conditions of the nation.

ISM Manufacturing Index measures manufacturing activity based on a monthly survey, conducted by Institute for Supply Management (ISM), of purchasing managers at more than 300 manufacturing firms.

The MSCI Emerging Markets Index captures large and mid cap representation across 27 Emerging Markets (EM) countries.

The MSCI ACWI ex USA Index captures large and mid cap representation across 22 of 23 Developed Markets (DM) countries (excluding the US) and 27 Emerging Markets (EM) countries*. With 2,359 constituents, the index covers approximately 85% of the global equity opportunity set outside the US

The S&P CoreLogic Case-Shiller 20-City Composite Home Price NSA Index seeks to measures the value of residential real estate in 20 major U.S. metropolitan areas. The U.S. Treasury index is based on the recent auctions of U.S. Treasury bills. Occasionally it is based on the U.S. Treasury’s daily yield curve.

The Consumer Price Index (CPI) measures the change in prices paid by consumers for goods and services. The CPI reflects spending patterns for each of two population groups: all urban consumers and urban wage earners and clerical workers.

In the United States, the Core Personal Consumption Expenditure Price (CPE) Index provides a measure of the prices paid by people for domestic purchases of goods and services, excluding the prices of food and energy.

The VIX Index is a calculation designed to produce a measure of constant, 30-day expected volatility of the U.S. stock market, derived from real-time, mid-quote prices of S&P 500® Index (SPX℠) call and put options. On a global basis, it is one of the most recognized measures of volatility — widely reported by financial media and closely followed by a variety of market participants as a daily market indicator.

The Conference Board’s Leading Indexes are the key elements in an analytic system designed to signal peaks and troughs in the business cycle. The leading, coincident, and lagging economic indexes are essentially composite averages of several individual leading, coincident, or lagging indicators. They are constructed to summarize and reveal common turning point patterns in economic data in a clearer and more convincing manner than any individual component – primarily because they smooth out some of the volatility of individual components.

Gross domestic product (GDP) is the standard measure of the value added created through the production of goods and services in a country during a certain period.

Index returns include the reinvestment of income and dividends. The returns for these unmanaged indexes do not include any transaction costs, management fees or other costs. It is not possible to make an investment directly in any index.

CCM-993