A Weaker September After New All-Time Highs Posted

HIGHLIGHTS:

- The S&P 500 Index rallied to a new all-time high as the month began, but weakness followed as the long-anticipated pause in the equity market run occurred in September.

- The high-flying NASDAQ Composite was particularly hard hit in September as technology slumped. This followed a period when a few large-cap technology companies had propelled broader market indices higher in recent months.

- The VIX Index rose early in the month and hit 33.6, its highest closing level since June. From that point, volatility declined to 26.37 by month’s end.

- The 10-year U.S. Treasury yield stayed in a rather tight range in September between 0.63% and 0.72% and it ended the month at 0.69%.

- Economic data reported in September continued to show progress in August, but readings moderated from recent months. The historic drop in GDP in the second quarter will be followed by a historic rebound in the third quarter.

- We expect a bumpy economic recovery as COVID-19 hotspots will continue to inevitably develop. Furthermore, we anticipate elevated market volatility as we are only about a month away from the presidential election.

- Late in September, the market seemed more focused (and hopeful) on another round of economic stimulus but failure on that front could spur volatility.

EQUITY MARKETS

After a remarkable multi-month run following the March lows, equity markets moved lower in September. The S&P 500 hit a new all-time high at the beginning of September, but it declined over the next few weeks and ended with a modest rebound during the final days of the month. The Dow Jones Industrial Average moved into positive year-to-date territory following gains in August but declines in September pushed it back into the red for the first three quarters of 2020. The NASDAQ Composite, which had outshined the other U.S. equity indices during 2020 also had the biggest drop in September. The largest, tech-focused companies have driven this index (and other indices) higher for most of the year and several of those names likewise led the index lower during September.

Interestingly, the CBOE Volatility Index or VIX Index, hit its highest level for September early in the month as markets were achieving new highs, but it declined as markets moved lower during the month. On September 2, the VIX Index closed at 33.6, the highest level since June, but it settled lower and closed the month at 26.37. This closing level was still roughly double where the VIX Index was in late 2019 and early 2020. Historically, the VIX spends about 28% of the time between 20 and 30 and less than 10% of the time above 30, so volatility is still elevated.

We had been anticipating higher levels of volatility as we approached the election and the economy encountered expected bumps along the way in the reopening process. In September, we started to experience more volatility (the month experienced the most 1% or more moves in the S&P 500 since April) and we anticipate that will be the environment in this final stretch before the election.

While a month is not a trend, we did see some reversal in September in the long-running trend of large-cap growth companies outpacing almost everything else. We at Clark Capital continue to use our disciplined approach of seeking out high-quality companies with improving business conditions at what we believe are good prices. The value/growth disparity has been and continues to be very stretched from our perspective, but some modest shifts occurred in September. As always, we will continue to make purposeful investments in both stocks and bonds as we move forward in what we believe will be a period of wider outcomes of investment results.

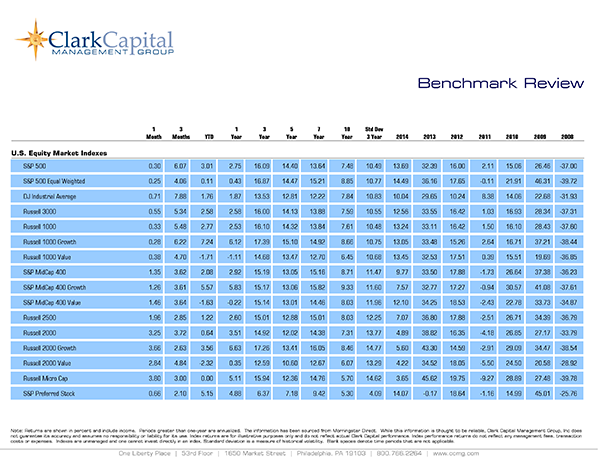

September returns were down across the board for equity markets after August had been one of the best months in years. The numbers for September were as follows: The S&P 500 declined -3.80%, the Dow Jones Industrial Average fell by -2.18%, the Russell 3000 slipped -3.64%, the NASDAQ Composite slumped -5.10% and the Russell 2000 Index, a measure of small-cap companies, was off -3.34%. Year-to-date results continue to show major dispersion among these broad indices and returns through September, in the same order, were as follows: 5.57%, -0.91%, 5.41%, 25.33%, and -8.69%, respectively. Reflecting the outperformance of large-cap companies, the S&P 500 Index (which is market-cap weighted) easily outpaced its equal weighted counterpart for the first nine months of the year. The S&P 500 Equal Weighted Index is down -4.75% year-to-date, but it did have a relatively better month, down -2.53%, compared to the headline, market-cap weighted S&P 500.

Despite a reversal in September, the dominance of growth is still clear year-to-date. For some perspective on the divergence between value and growth stocks, consider the following indices. The Russell 1000 Index is up 6.4% year-to-date. However, the Russell 1000 Growth Index has advanced 24.33% year-to-date, but it was down -4.71% in September. The Russell 1000 Value index declined -11.58% year-to-date but was off a more modest -2.46% for the month.

The large-cap growth trend paused in September as small-caps and large-cap value stocks performed relatively better during the month. However, the divide between large-cap growth and most other pockets of the market remained wide as the year-to-date numbers indicate. In our opinion, this divergence between growth and value is still extreme and at some point, will return closer to longer-term norms.

International equities showed weakness in September as well, but with some modest relative outperformance to the U.S. during the month. The MSCI Emerging Markets Index fell -1.60% in September and the MSCI ACWI ex USA Index, a broad measure of international equities, declined -2.46% with year-to-date returns of -1.16% and -5.44%, respectively.

FIXED INCOME

The yield on the 10-year U.S. Treasury traded in a narrow range during September deviating less than 10 basis points from its high of 0.72% to its low of 0.63% for the month. This rather flat interest rate environment created an equally subdued period for bond returns. The ongoing and massive support from the Federal Reserve is generally keeping a lid on interest rates. We anticipate a “lower for longer” interest rate environment to persist for the foreseeable future and overall, bond results were mixed during the month.

For September, fixed income returns were as follows: the Bloomberg Barclays U.S. Aggregate Bond Index fell -0.05%, the Bloomberg Barclays U.S. Credit Index declined -0.27%, the Bloomberg Barclays U.S. Corporate High Yield Index dropped -1.03% and the Bloomberg Barclays Municipal Index rose modestly by 0.02%. Treasuries still show solid results year-to-date driven by powerful first quarter returns, with most Treasury indices outside of TIPS (which fell -0.37% for the month) rising fractionally during September.

High yield bonds declined alongside equities during the month, but were still modestly positive, up 0.62%, year-to-date. This lags most other bond sectors through the first nine months of the year.

ECONOMIC DATA AND OUTLOOK

The economic rebound in the third quarter will be as historic as the decline in GDP in the second quarter. The final reading of second quarter GDP showed an annualized decline of -31.4%, but the GDPNow estimate released by the Federal Reserve Bank of Atlanta is indicating a rebound of 32.0% in the third quarter. The economy continued to show improvement in August, but the pace of some economic readings moderated from the powerful recovery following the second quarter. As we had anticipated, the second quarter was the largest economic decline in history, but we believe the recession will be the shortest on record as well and the recovery has been incredibly strong from the nadir in economic activity.

The job market showed ongoing strength in August. Non-farm payrolls increased by over 1.37 million in August, ahead of the anticipated 1.35 million gain, but below the prior month’s increase of more than 1.7 million. The unemployment rate was expected to decline to 9.8%, but it fell to a better-than-anticipated 8.4%. Clearly, the job market has rebounded strongly from the massive layoffs that occurred as the economy shut down. However, when compared to the 3.5% unemployment rate at the end of 2019, there is still a lot of ground to make up in the labor market. We continue to expect a bumpy path for this recovery, but the job market has continued to see people get back to work following the shutdown in many parts of our economy.

The widely followed ISM Manufacturing Index rose to 56.0 in August, ahead of the expected reading of 54.8, remaining comfortably in expansion territory above 50. (For September, this index moderated to 55.4 and was below expectations.) The New Orders component of this reading has rebounded strongly and in August, it came in at a remarkable 67.6, which was well ahead of expectations of 58.8. The ISM Non-Manufacturing Index, which covers the much larger service industries in the U.S. economy, just missed estimates of 57.0 coming in at 56.9. This was a drop from July’s mark of 58.1. Clearly, manufacturing and service industries have improved from the shutdown period and show solid growth, but gains have moderated of late.

Retail sales continued to advance, but the pace of gains has slowed over the last two months. Excluding auto and gas station sales, retail sales increased 0.7%, below the expected gain of 0.9%, and well below June’s improvement of 7.7% and July’s gain of 1.1%. New home sales surged to a more than 1 million annualized pace in August, a 14-year high, and were well ahead of the anticipated 890,000 annualized rate. However, housing starts and building permits both missed their estimates and were both down from the prior month. Existing home sales at a 6 million annualized rate were in-line with expectations for August and improved from July.

Consumer confidence, as measured by the preliminary reading of the University of Michigan consumer sentiment survey for September, improved more than expected to 78.9 compared to estimates of 75.0. The Conference Board’s Leading Index gained 1.2% for the month of August, just below expectations of 1.3%, but July was revised higher from 1.4% to 2.0%.

As some of the data seems to be reflecting, the pace of improvement is now slowing somewhat. We had anticipated that the third quarter would rebound strongly and while the fourth quarter would reflect above trend economic growth, it would be much more muted compared to the third quarter. While improvements are being made, we believe it will take until late 2022 or early 2023 to return to the peak levels of economic output we were at pre-pandemic in February.

There has been no change in the Fed’s stance as they continue to exhibit an “all in” attitude to support the financial system. Late in the month, prospects seemed to improve modestly that another round of pandemic relief could come from the fiscal side and negotiations were ongoing. The dollar amounts are vastly different between the Democrats and Republicans, but some modest optimism developed that this 5th round of stimulus might still come together. While this raised hopes late in the month and markets responded positively, it could also be a source of disappointment if nothing materializes.

Equity markets had enjoyed a remarkable rebound following the lows in March with relatively little volatility. That changed somewhat in September as a not too surprising pause occurred in the market. We remain resolute in our belief that the U.S. economy and corporate America will make it through this pandemic. This stance has not changed since the beginning of the crisis.

We do expect elevated volatility in the weeks ahead as the presidential election takes center stage and it looks more likely that the winner may not be known on election night. However, at this point, we believe the economy and financial markets are heading in the right direction. We believe it is imperative for investors to stay focused on their long-term goals and not let short-term swings in the market derail them from their longer-term objectives.

INVESTMENT IMPLICATIONS

Clark Capital’s Top-Down, Quantitative Strategies

The markets endured a correction in September following a run into record territory, giving back a small portion of the massive gain from the March lows. The good news is that the uptrend remains intact, the correction has relieved some pressure driven by too optimistic investor sentiment, and we are beginning to see some of the economic re-opening themes perform well, including basic materials, cyclicals, and industrials. Through the first nine months of the year, large-cap and large-cap growth themes have been clear winners, while value has lagged significantly. The performance spread between large-cap growth and large-cap value is an eye-popping 35.91%.

The Style Opportunity portfolio remains primarily invested in large-caps, with a focus on growth given its persistently strong relative strength. A small tweak to the portfolio was made during the month by adding momentum and trimming large-cap growth exposure. The Global Tactical portfolio is fully invested in equities, having shifted its exposure from risk-off in U.S. Treasuries into a risk-on position on July 30th as the strategy’s risk management models turned bullish. The portfolio held up relatively well during the month even as the markets corrected.

International markets, which have not rebounded as strongly as the U.S., held up better during the recent weakness. Fixed Income Total Return remains invested in high yield. The high yield market did have a correction in September, as did other risk-on asset classes. During that corrective period, credit remain well supported and there was little evidence of a flight to safety with U.S. Treasury yields remaining flat.

Clark Capital’s Bottom-Up, Fundamental Strategies

Although COVID cases are rising, the economy continues to reopen which benefits value oriented, cyclical industries such as Transports and Materials. Despite the September market decline, growth stocks continue to outperform value by a wide margin for the year. Any rally in value stocks has been short lived, with the worst laggards found in the hard-hit Bank, Energy and Consumer Discretionary stocks.

In September, the High Dividend Equity portfolio purchased a construction machinery and equipment company and increased its position in a transportation company. From a macro perspective, both of those companies are benefactors of the economic re-opening theme. In All Cap, Technology and Consumer Discretionary remain its largest sector weights.

In fixed income, the 10-year U.S. Treasury yield remained steady during the month around 0.70% while junk credit spreads widened in sympathy with the increase in daily COVID cases. Heavy new issue supply in both investment grade and high yield corporate debt kept dealers busy pricing and placing bonds. The Taxable Fixed Income portfolio continues to reinvest proceeds from bonds that are being called.

| Event | Period | Estimate | Actual | Prior | Revised |

|---|---|---|---|---|---|

| ISM Manufacturing | Aug | 54.8 | 56 | 54.2 | — |

| ISM Services Index | Aug | 57 | 56.9 | 58.1 | — |

| Change in Nonfarm Payrolls | Aug | 1.350m | 1.371m | 1.763m | 1.734m |

| Unemployment Rate | Aug | 9.80% | 8.40% | 10.20% | — |

| Average Hourly Earnings YoY | Aug | 4.50% | 4.70% | 4.80% | 4.70% |

| JOLTS Job Openings | July | 6000k | 6618k | 5889k | 6001k |

| PPI Final Demand MoM | Aug | 0.20% | 0.30% | 0.60% | — |

| PPI Final Demand YoY | Aug | -0.30% | -0.20% | -0.40% | — |

| PPI Ex Food and Energy MoM | Aug | 0.20% | 0.40% | 0.50% | — |

| PPI Ex Food and Energy YoY | Aug | 0.30% | 0.60% | 0.30% | — |

| CPI MoM | Aug | 0.30% | 0.40% | 0.60% | — |

| CPI YoY | Aug | 1.20% | 1.30% | 1.00% | — |

| CPI Ex Food and Energy MoM | Aug | 0.20% | 0.40% | 0.60% | — |

| CPI Ex Food and Energy YoY | Aug | 1.60% | 1.70% | 1.60% | — |

| Retail Sales Ex Auto and Gas | Aug | 0.90% | 0.70% | 1.50% | 1.10% |

| Industrial Production MoM | Aug | 1.00% | 0.40% | 3.00% | 3.50% |

| Building Permits | Aug | 1512k | 1470k | 1495k | 1483k |

| Housing Starts | Aug | 1488k | 1416k | 1496k | 1492k |

| New Home Sales | Aug | 890k | 1011k | 901k | 965k |

| Existing Home Sales | Aug | 6.0m | 6.0m | 5.86m | — |

| Leading Index | Aug | 1.30% | 1.20% | 1.40% | 2.00% |

| Durable Goods Orders | Aug P | 1.50% | 0.40% | 11.40% | 11.70% |

| GDP Annualized QoQ | 2Q T | -31.70% | -31.40% | -31.70% | — |

| U. of Mich. Sentiment | Sep P | 75 | 78.9 | 74.1 | — |

| Personal Income | Aug | -2.50% | -2.70% | 0.40% | 0.50% |

| Personal Spending | Aug | 0.80% | 1.00% | 1.90% | 1.50% |

| S&P CoreLogic CS 20-City YoY NSA | July | 3.60% | 3.95% | 3.46% | — |

Source: Bloomberg

Past performance is not indicative of future results. The opinions expressed are those of the Clark Capital Management Group portfolio manager(s) that manage the strategies or products discussed herein, and do not necessarily reflect the opinions of all portfolio managers at Clark Capital Management Group or the firm as a whole. The opinions referenced are as of the date of publication and are subject to change due to changes in the market or economic conditions and may not necessarily come to pass. Nothing herein should be construed as a solicitation, recommendation or an offer to buy, sell or hold any securities, other investments or to adopt any investment strategy or strategies.

There is no guarantee of the future performance of any Clark Capital investment portfolio. This is not financial advice or an offer to sell any product. Clark Capital Management Group reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs. It should not be assumed that any of the investment recommendations or decisions we make in the future will be profitable or will equal the investment performance of the securities discussed herein. Clark Capital Management Group is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training. More information about Clark Capital Management Group’s advisory services can be found in its Form ADV which is available upon request.

Fixed income securities are subject to certain risks including, but not limited to: interest rate (changes in interest rates may cause a decline in market value or an investment), credit, prepayment, call (some bonds allow the issuer to call a bond for redemption before it matures), and extension (principal repayments may not occur as quickly as anticipated, causing the expected maturity of a security to increase).

Non-investment-grade debt securities (high-yield/junk bonds) may be subject to greater market fluctuations, risk of default or loss of income and principal than higher-rated securities.

Foreign securities are more volatile, harder to price and less liquid than U.S. securities. They are subject to different accounting and regulatory standards and political and economic risks. These risks are enhanced in emerging market countries.

The U.S. Dollar Index is an index of the value of the United States dollar relative to a basket of foreign currencies, often referred to as a basket of U.S. trade partners’ currencies. The Index goes up when the U.S. dollar gains “strength” when compared to other currencies.

The S&P 500® Equal Weight Index (EWI) is the equal-weight version of the widely-used S&P 500. The index includes the same constituents as the capitalization weighted S&P 500, but each company in the S&P 500 EWI is allocated a fixed weight – or 0.2% of the index total at each quarterly rebalance.

The Bloomberg Barclays U.S. Municipal Index covers the USD-denominated long-term tax exempt bond market. The index has four main sectors: state and local general obligation bonds, revenue bonds, insured bonds and prerefunded bonds.

The Dow Jones Industrial Average indicates the value of 30 large, publicly owned companies based in the United States.

The NASDAQ Composite is a stock market index of the common stocks and similar securities listed on the NASDAQ stock market.

The S&P 500 measures the performance of the 500 leading companies in leading industries of the U.S. economy, capturing 75% of U.S. equities. .

The Russell 1000 Growth Index measures the performance of the large-cap growth segment of the U.S. equity universe. It includes those Russell 1000 Index companies with higher price-to-book ratios and higher forecasted growth values.

Russell 1000 Index measures the performance of the 1,000 largest companies in the Russell 3000 Index, which represents approximately 92% of the total market capitalization of the Russell 3000 Index.

The Russell 1000 Value Index measures the performance of the large-cap value segment of the U.S. equity universe. It includes those Russell 1000 Index companies with lower price-to-book ratios and lower forecasted growth values.

The Russell 2000 Index is a small-cap stock market index that represents the bottom 2,000 stocks in the Russell 3000.

The Russell 3000 Index measures the performance of the 3,000 largest U.S. companies based on total market capitalization, which represents approximately 98% of the investable U.S. equity market.

The 10 Year Treasury Rate is the yield received for investing in a US government issued treasury security that has a maturity of 10 year. The 10 year treasury yield is included on the longer end of the yield curve. Many analysts will use the 10 year yield as the “risk free” rate when valuing the markets or an individual security.

The MSCI Emerging Markets Index is used to measure large and mid-cap equity market performance in the global emerging markets.

The MSCI ACWI ex USA Index captures large and mid-cap representation across 22 of 23 developed market countries and 24 emerging market countries, covering approximately 85% of the global equity opportunity set outside of the U.S.

Bloomberg Barclays U.S. Aggregate Bond Index: The index is unmanaged and measures the performance of the investment grade, U.S. dollar denominated, fixed-rate taxable bond market, including Treasuries and government-related and corporate securities that have a remaining maturity of at least one year.

The Bloomberg Barclays U.S. Corporate High-Yield Index covers the U.S. dollar-denominated, non-investment grade, fixed-rate, taxable corporate bond market. Securities are classified as high-yield if the middle rating of Moody’s, Fitch, and S&P is Ba1/BB+/BB+ or below.

The Bloomberg Barclays U.S. Credit Index measures the investment grade, U.S. dollar denominated, fixed-rate taxable corporate and government related bond markets.

The ISM Non-Manufacturing Index is an index based on surveys of more than 400 non-manufacturing firms’ purchasing and supply executives, within 60 sectors across the nation, by the Institute of Supply Management (ISM). The ISM Non-Manufacturing Index tracks economic data, like the ISM Non-Manufacturing Business Activity Index. A composite diffusion index is created based on the data from these surveys, that monitors economic conditions of the nation.

ISM Manufacturing Index measures manufacturing activity based on a monthly survey, conducted by Institute for Supply Management (ISM), of purchasing managers at more than 300 manufacturing firms.

Personal consumption expenditures price index is the component statistic for consumption in gross domestic product collected by the United States Bureau of Economic Analysis.

The 3 Year Treasury Rate is the yield received for investing in a US government issued treasury security that has a maturity of 3 year.

The 5 Year Treasury Rate is the yield received for investing in a US government issued treasury security that has a maturity of 5 year.

The CBOE Volatility Index, known by its ticker symbol VIX, is a popular measure of the stock market’s expectation of volatility implied by S&P 500 index options.

The Conference Board’s Leading Indexes are the key elements in an analytic system designed to signal peaks and troughs in the business cycle. The leading, coincident, and lagging economic indexes are essentially composite averages of several individual leading, coincident, or lagging indicators. They are constructed to summarize and reveal common turning point patterns in economic data in a clearer and more convincing manner than any individual component – primarily because they smooth out some of the volatility of individual components.

The volatility (beta) of a client’s portfolio may be greater or less than its respective benchmark. It is not possible to invest in these indices.

Index returns include the reinvestment of income and dividends. The returns for these unmanaged indexes do not include any transaction costs, management fees or other costs. It is not possible to make an investment directly in any index.

CCM-993