November 4, 2020 | Mercifully, Election Day has finally come and gone. It is hard to imagine life without listening to political pundits, watching seemingly endless commercials, and having discussions with family and friends that turn into heated debates! Well sadly, some of that will continue as the ultimate winner is finally determined.

While we don’t have a winner yet, we know that that the pollsters were big losers again. The polls were again massively incorrect, and the voting tally so far shows that there was not a huge national lead for Biden heading into Election Day.

The winner of the presidential election needs 270 Electoral College votes to declare victory. As the country woke up on November 4th, the Electoral College count is Biden 238, Trump 213. They both still have paths to secure the 270 needed for victory. Six states remain undecided with Georgia, Wisconsin, Michigan, North Carolina, Pennsylvania, and Nevada still not called for either candidate. However, the partial results so far suggest lower odds that Democrats win both the White House and Senate than polls implied at the start of Election Day. To reclaim the Senate, the Democrats needed to pick up three seats if Biden won and four seats if Trump won. Results so far suggest the Democrats picked up two seats.

So now what?

The last time we had a situation like this goes back to the 2000 election between George W. Bush and Al Gore. We all learned what a hanging chad was and that counting is much more complicated than we thought! We also learned that the old expression “the market can handle good news and bad news, but not uncertainty,” has a basis in truth. The S&P 500 declined nearly 5% from November 7, 2000 (the day before the election) until December 12, 2000 (the day before Bush was officially declared the winner). It would not be surprising to see heightened levels of volatility as politicians and lawyers battle over deadlines, procedures, and outcomes.

Ballot counting continues in key battleground states, including Georgia, Wisconsin, Michigan, North Carolina, and Pennsylvania. Due to laws barring the processing of mail-in ballots before Election Day, election officials in Michigan and Pennsylvania have said that it may take until Friday to count all of the ballots. Officials in Georgia, North Carolina, and Wisconsin said they expect their larger cities to be done counting by Wednesday. In North Carolina, mail-in ballots that were postmarked by Election Day will be counted if they arrive by November 12.

Below is a roadmap of key dates as we embark on this journey:

| Nov. 5- Dec. 12 | Dates vary for states to certify the results |

| Dec. 14 | Electors cast their ballots. The candidate with 270 or more wins |

| Jan. 6 | Joint session of Congress convenes and Vice President Pence presiding to certify the results |

| Jan. 20 | President and Vice President are sworn into office |

Once the dust settles and the next President is finally named, investors will once again focus on the things that truly matter – the fundamentals. We believe the economic rebound we have been experiencing should continue, no matter which candidate ultimately wins. Republicans and Democrats should finally be able to pass an additional economic stimulus package. The long-awaited infrastructure package, which may be the only thing both parties actually agree on, will likely get passed.

For fiscal policy, Senate control is at least as important as the White House. Under a narrow Republican Senate majority, we would expect no major tax increases, but also a fiscal stimulus package of less than $1 trillion. With a Democratic Senate, we would expect Congress to enact a fiscal stimulus package of at least double that size regardless of the White House outcome, though the size could grow a bit larger if Biden wins the White House (to $2.5 to $3 trillion). Tax increases that go to fund additional spending increases would likely also occur under a Democratic sweep, but not under a Democratic Senate and a Trump White House.

Interest rates are likely to stay low, but there may be some upward pressure if Biden wins and some of the more expensive measures (universal healthcare for example) are implemented. An increase in tax rates, both corporate and personal, will influence rates as well. Higher corporate taxes should act as a governor on rates and higher personal tax rates will likely increase the appeal of municipal bonds.

The chart below highlights some of the initiatives Biden has endorsed regarding taxes.

| Corporate | Individual |

|---|---|

| Increase Corporate Tax Rate to 28% (vs. current 21%) | Reinstitute top tax bracket of 39.6% (vs current 37%) |

| Increase CIL TI Tax on U.S. foreign subs from 10.5% to 21% | Limit itemized deductions on income >$400k |

| Minimum 15% tax on reported book income | Ordinary tax rate on Cap Gains & Divis on income >$1MM |

| Repeal certain tax breaks for Real Estate & Fossil Fuels | Phase out qualified business deduction on income >$400k |

| Addt'l Social Security tax (12.4% EE/ER) on wages >$400k | |

| Repeal SALT deduction limitation |

The chart below demonstrates that stocks have managed to go up in value no matter who is in control of Washington.

| Situation | Number of Years | S&P 500 Index Annual Average Return |

|---|---|---|

| Unified Republican | 13 years | 14.52% |

| Unified Democrat | 34 years | 14.52% |

| Divided with Republican President | 33 years | 6.99% |

| Divided with Democratic President | 14 years | 15.94% |

Past performance is not indicative of future results

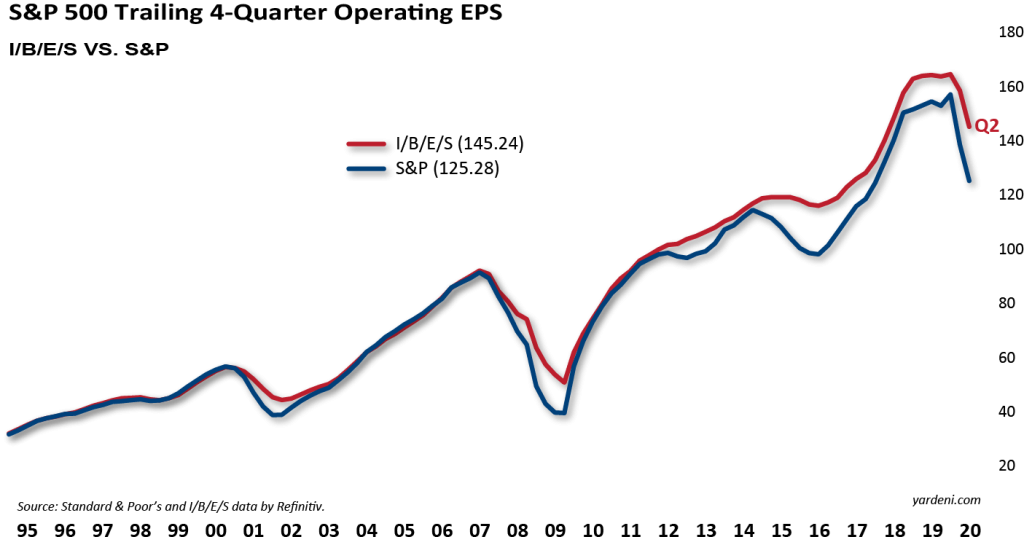

As we mention above, after the election noise is behind us, we believe the market will return to focusing on fundamentals, such as corporate earnings, interest rates, and the economy. We know that over time, stock prices track earnings and that earnings are highly correlated to the economy.

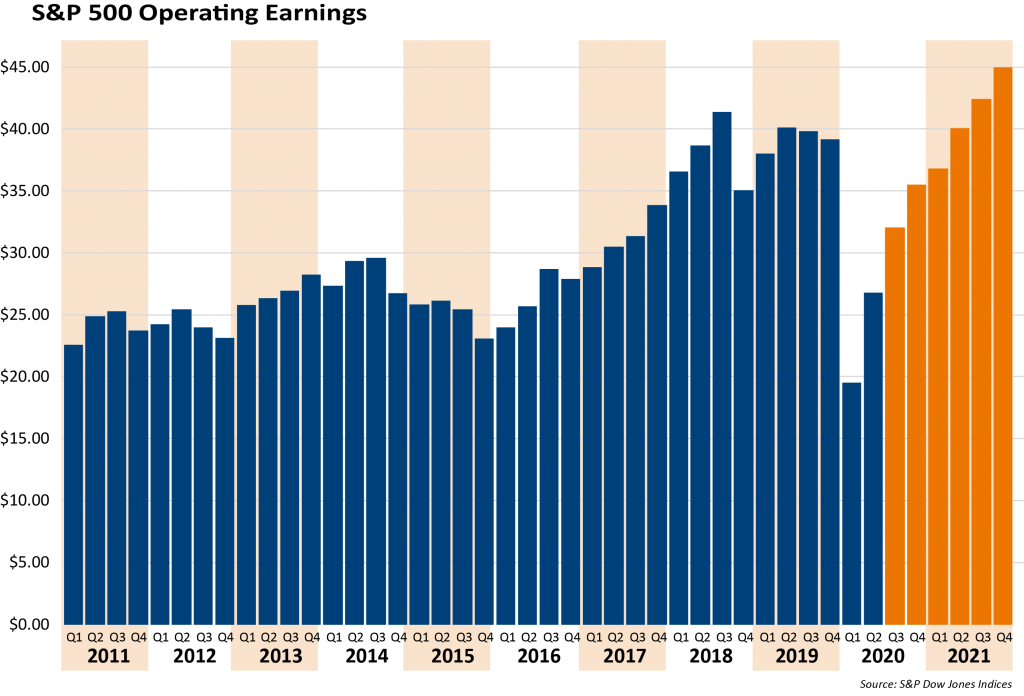

S&P 500 earnings are rebounding strongly since the COVID-inspired drop earlier this year. Analysts’ estimates indicate that earnings will eclipse their prior levels in the second half of 2021.

Source: S&P Dow Jones Indices (Slide 5 of the Q3 CPM Deck)Projections or other forward looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially

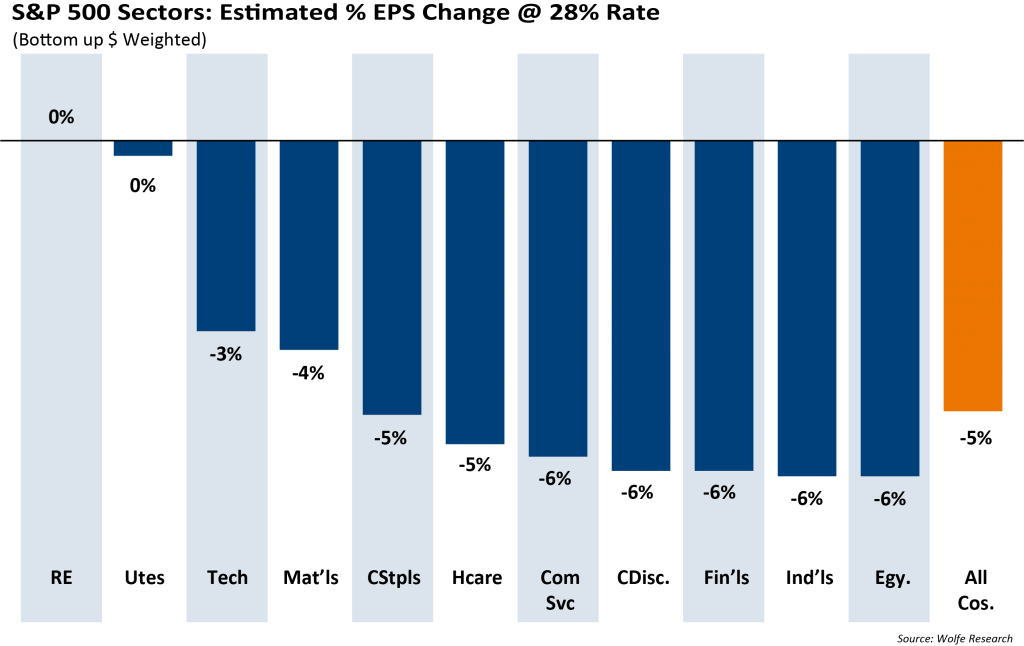

Source: S&P Dow Jones Indices (Slide 5 of the Q3 CPM Deck)Projections or other forward looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materiallyAs seen in the chart below, certain sectors will be impacted more than others if the top corporate rate is raised to 28% from the current level of 21%. This will clearly factor into our analysis of companies and their earnings prospects.

Whether you are happy with the ultimate election results or not, the world will continue. We think it is important to take a step back and realize that events around elections are just noise. Companies that grow their earnings will, over time, see their stock prices go up. This has been true under Republican and Democratic Presidents.

As we have often said, we believe the five drivers of stock prices over time are the economy, monetary policy, valuations, investor sentiment and interest rates. Notice that politics is not included in the drivers of stock prices over time. We seek to invest in good companies, not politicians. We continue to believe sticking to our discipline of investing in high-quality companies with improving business characteristics (which often leads to higher dividends) that we can purchase at an attractive price is the best way to deliver superior risk-adjusted returns and meaningful diversification.

As always, we believe that the surest way for clients to achieve financial success is to remain focused on their long-term goals and objectives. Clark Capital is committed to helping you and your clients navigate challenging market conditions. Please reach out to us with any questions.

If you would like to discuss your clients’ investment or tax considerations, contact a Clark Capital Investment Consultant: 800.766.2264

The opinions expressed are exclusively the opinions of the author(s) and do not necessarily reflect the views of Clark Capital Management Group.

The opinions referenced are as of the date of publication and are subject to change due to changes in the market or economic conditions and may not necessarily come to pass. There is no guarantee of the future performance of any Clark Capital investments portfolio. Material presented has been derived from sources considered to be reliable, but the accuracy and completeness cannot be guaranteed. Nothing herein should be construed as a solicitation, recommendation or an offer to buy, sell or hold any securities, other investments or to adopt any investment strategy or strategies. For educational use only. This information is not intended to serve as investment advice. This material is not intended to be relied upon as a forecast or research.

The S&P 500 Index is a stock market index that measures the stock performance of 500 large companies listed on stock exchanges in the United States. An obligor rated ‘BBB’ has adequate capacity to meet its financial commitments. However, adverse economic conditions or changing circumstances are more likely to lead to a weakened capacity of the obligor to meet its financial commitments.

This document may contain certain information that constitutes forward-looking statements which can be identified by the use of forward-looking terminology such as “may,” “expect,” “will,” “hope,” “forecast,” “intend,” “target,” “believe,” and/or comparable terminology (or the negative thereof). Forward looking statements cannot be guaranteed. No assurance, representation, or warranty is made by any person that any of Clark Capital’s assumptions, expectations, objectives, and/or goals will be achieved. Nothing contained in this document may be relied upon as a guarantee, promise, assurance, or representation as to the future.

Clark Capital Management Group, Inc. is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training. More information about Clark Capital’s advisory services and fees can be found in its Form ADV which is available upon request.

CCM-500