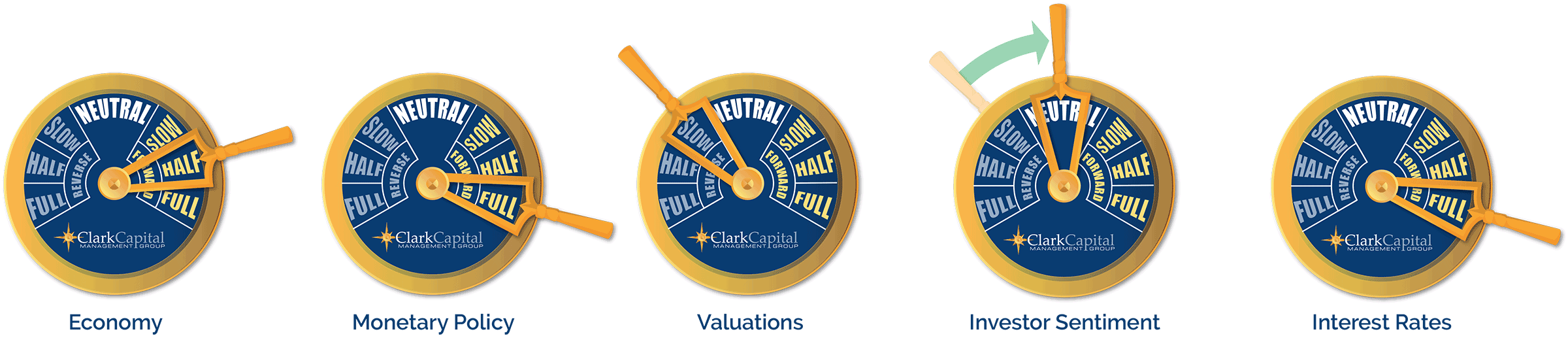

Clark Capital’s Economic Gauges

Market Moves: Charting Our Strategies, October 2020

Clark Capital’s Bottom-Up, Fundamental Strategies

The global markets corrected again in October, peaking mid-month, and then pulling back, as a steady rise in COVID cases prompted several European countries including Germany, France, and England to institute a new round of social and economic restrictions. U.S. election uncertainty also seems to have weighed on investor sentiment. Third quarter earnings reports mirror the second quarter’s positive trends as earnings exceeding expectations hit high levels. Analysts have been slow to react to either positive consumer trends or corporate management’s ability to cut costs to combat revenue declines.

In our bottom-up equity portfolios, as economic activity continues to recover, we continue to look for compelling companies with underappreciated business momentum (estimates are too low) or a valuation that does not reflect the quality and longer-term business prospects. For example, the High Dividend Equity portfolio purchased a leading global provider of electrical connection and protection solutions that has been unduly punished for exposure to commercial construction and energy end markets. We expect the company’s earnings to continue to exceed expectations and for the company to relatively outperform industrial peers in 2021 as those segments pick up and management demonstrates resiliency of margins.

In our fixed income strategies, the Taxable Fixed Income portfolio continued to see companies refinance bonds in the BB credit space that we own. In the Tax-Free Fixed Income portfolio, the headwinds of supply, credit erosion and political/economic uncertainty hold fast. While supply was outsized during the month as we forecasted, 30-40% was taxable. So, while the market cheapened overall, in a sense, exempt paper became harder to find and helped insulate performance, a key factor when states like NJ, NY and CA rattle the tax increase sabre.

Below are strategy updates from October:

All Cap Core U.S. Equity

- The Navigator® All Cap strategy is positioned with 66.6% in large-cap stocks with the remainder in mid and small-cap stocks and cash.

- The portfolio continues to balance holdings and adjustments between those companies which we believe will benefit from work-from-home trends and the those which will benefit from economic re-opening. In the latter case, we are diligent with respect to a company’s measured antifragility measures and credit exposure as the weakest parts of the economy continue to struggle.

- The strategy added many SMID Cap companies during the month including an M&A specialist and a home services company. We removed two holdings from the portfolio during the month as we believe other opportunities present higher prospective growth rates.

- Technology remains the largest sector weight in the strategy at 21.9%. Consumer Discretionary, Financials and Healthcare are our next biggest sector exposures each with weightings between 14.3% and 16.9%.

High Dividend Equity

- As economic activity continues to recover, we look for compelling companies with underappreciated business momentum (estimates are too low) or a valuation that does not reflect the quality and longer-term business prospects.

- During the month, we purchased a leading global provider of electrical connection and protection solutions along with a property and casualty company that has historically demonstrated the ability to compound book value.

- Sales for the month included an aerospace company, a multinational investment bank and financial services company, and a multinational energy company.

- The best performing sectors for the month were Technology, Energy and Utilities versus detractors Consumer Discretionary, Financials and Healthcare.

International Equity ADR

- Navigator® International Equity/ADR is positioned with 16.8% in emerging markets with the balance in developed economies.

- Britain, Japan and Switzerland are the strategy’s largest country weights, all between 12% and 14%.

- ADR continues to find high quality work-from-home beneficiaries and cyclicals. To this end, ADR added a Japanese manufacturer, a European pharmaceutical company, and a German automaker. The portfolio also removed three European companies during the month.

- Technology and Financials remain our largest sector weights. While U.S. security selection has been concentrated in the large-cap growth area this year, performance is broadening internationally.

Small Cap Core U.S. Equity

- 71.2% of the Navigator® Small Cap portfolio is positioned in small-cap stocks with the balance in mid-cap stocks and cash.

- Industrials, Technology, Consumer Discretionary and Healthcare are now the largest sectors in the portfolio (each between 16.4% and 19.0%).

- With the exception of a small addition of a biotech company, very few changes were made to the strategy during the month as a vast majority of our holdings continue to remain in what we believe are high quality, undervalued companies that continue to outperform their earnings expectations.

SMID Cap Core U.S. Equity

- 62.1% of the Navigator® SMID Cap portfolio is positioned in small-cap stocks with the balance in mid-cap stocks and cash.

- Industrials and Consumer Discretionary are now the largest sector weights (each between 18.7% and 19%) as economic conditions continue to improve. Technology, Healthcare, and Financials represent our next largest sector weights, each greater than 13%.

- Very few changes were made to the strategy during the month as a vast majority of our holdings continue to be in what we believe are high quality, undervalued companies that continue to outperform their earnings expectations.

Taxable Fixed Income

- October continued to see companies refinance bonds in the BB credit space that we own.

- Sector allocations continued to be bolstered by adding to Technology. Bank and finance spreads widened towards the end of the month slightly, and we added there as well.

- During the month, we continued to look for companies that can benefit from a re-finance trade. We identified one in Technology and one in Energy that we believe are relatively attractive positions for the portfolio.

- Overall, the fixed income market was remarkedly resilient. Selective buying of fixed income continued into month end with spreads firm.

Tax-Free Fixed Income

- While the headwinds of supply, credit erosion and political/economic uncertainty hold fast, we continue to tactically focus on tailwinds in the asset class.

- While supply was outsized as we forecasted, 30-40% was taxable. So, while the market cheapened overall, in a sense, exempt paper became harder to find and helped insulate performance— a key factor when states like NJ, NY and CA rattle the tax increase sabre.

- We will avoid bending on credit for the sake of yield, as we believe this is a losing approach.

- We will continue to monitor duration: while we may have been early in extending duration, the velocity of relative value and price appreciation is now moving to longer maturities. Yield levels offer little to be desired in the 2, 3 and 4-year maturities. With 1-year municipal yields trading high relative to Treasuries, it affords us the opportunity to balance duration via a barbell strategy if required.

Clark Capital’s Top-Down, Quantitative Strategies

The economy grew by a record 33% annualized real rate in the third quarter, after declining 5% in the first quarter and a record 31% in the second quarter. We expected the economy to bounce back strongly, and it did. Overall, the economy is still down in aggregate, but incredibly it is only off by about 3% in nominal terms since its quarterly peak in December 2019. We believe the economy has a lot of momentum and is likely to continue posting strong growth rates over the next several quarters.

The relative strength models that guide our top-down strategies have been very persistent in favoring large-cap and growth styles. We are beginning to see signs of emerging relative improvement in both mid and small-caps, as trends begin to broaden out with the economic reopening themes gathering strength.

In Fixed Income Total Return, our models have remained strong, in favoring high yield as credit has remained very strong even during the equity correction in the second half of October. In our Alternative Opportunity portfolio, recent moves include adding to commodities and related stocks as they benefit from economic reopening themes.

Below are strategy updates from October:

Alternative

- The Alternative Opportunity portfolio seeks to provide diversification as the markets become more volatile. The VIX Index has remained elevated, peaking at just over 40 near the end of October.

- The portfolio contains a mix of market neutral, managed futures, commodity, currency, equity, and fixed income allocations.

- Recent moves include reducing exposure to emerging market debt and adding to existing commodity holdings and commodity related stocks as they benefit from economic reopening themes.

Fixed Income Total Return

- Fixed Income Total Return moved back into high yield on July 30th and since then, the models that drive the strategy have remained strong, in favoring high yield.

- Credit has remained very strong even during the equity correction in the second half of October. The high yield index sits just 1.05% from its all-time high hit on October 13.

- Additionally, Treasury yields have begun to climb back up with the 10-year Treasury yield rising to 0.86%. As a result, credit spreads remain supportive of risk-on allocations.

Style Opportunity

- Relative strength models that drive the strategy have been very persistent favoring large-cap and growth styles. As a result, the strategy remains allocated to 98% in large-cap stocks and is focused on growth.

- We are beginning to see signs of emerging relative improvement in both mid and small-caps as trends begin to broaden out with economic reopening themes gathering strength.

- If these emerging trends continue, the strategy would gravitate to those styles.

The S&P 500 Index is a stock market index that tracks the stocks of 500 large-cap U.S. companies.

Fixed income securities are subject to certain risks including, but not limited to: interest rate (changes in interest rates may cause a decline in market value of an investment), credit, payment, call (some bonds allow the issuer to call a bond for redemption before it matures), and extension (principal repayments may not occur as quickly as anticipated, causing the expected maturity of a security to increase).

Foreign securities are more volatile, harder to price and less liquid than U.S. securities. They are subject to different accounting and regulatory standards and political and economic risks. These risks are enhanced in emerging market countries.

Municipal securities can be affected by adverse tax, legislative or political changes and the financial conditions of the issuers of the municipal securities.

Municipal bonds can be significantly affected by political and economic changes, including inflation, as well as uncertainties in the municipal market related to taxation, legislative changes, or the rights or municipal security holders. Municipal bonds have varying levels of sensitivity to changes in interest rates. Interest rate risk is generally lower for shorter-term municipal bonds and higher for long term municipal bonds.

The trade-weighted dollar is an index created by the FED to measure the value of the USD, based on its competitiveness versus trading partners. A trade-weighted dollar is a measurement of the foreign exchange value of the U.S. dollar compared against certain foreign currencies.

The Bloomberg Barclays US Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, US dollar-denominated, fixed-rate taxable bond market. The index includes Treasuries, government-related and corporate securities, MBS (agency fixed-rate pass-throughs), ABS and CMBS (agency and non-agency).

The Bloomberg Barclays US Intermediate Corporate Bond Index measures the investment grade, fixed-rate, taxable corporate bond market. It includes USD-denominated securities publicly issued by US and non-US industrial, utility and financial issuers that have between 1 and up to, but not including, 10 years to maturity.

The Bloomberg Barclays Municipal Bond 5-year Total Return Index covers the USD-denominated long-term tax exempt bond market.

The Bloomberg Barclays US Corporate High Yield Bond Index measures the USD-denominated, high yield, fixed-rate corporate bond market.

This document may contain certain information that constitutes forward-looking statements which can be identified by the use of forward-looking terminology such as “may,” “expect,” “will,” “hope,” “forecast,” “intend,” “target,” “believe,” and/or comparable terminology (or the negative thereof). Forward looking statements cannot be guaranteed. No assurance, representation, or warranty is made by any person that any of Clark Capital’s assumptions, expectations, objectives, and/or goals will be achieved. Nothing contained in this document may be relied upon as a guarantee, promise, assurance, or representation as to the future.

Clark Capital Management Group, Inc. is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training. More information about Clark Capital’s advisory services and fees can be found in its Form ADV which is available upon request. CCM-1188