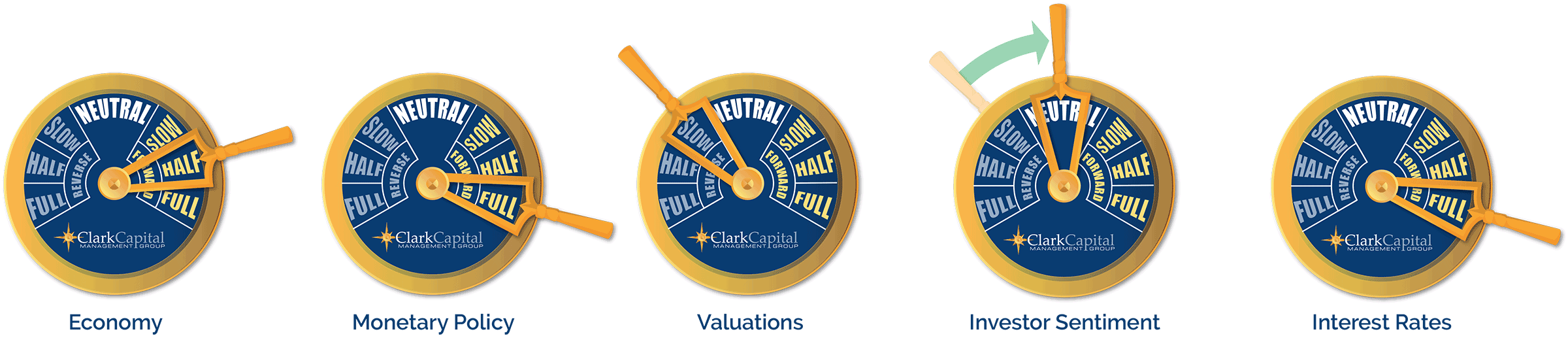

Clark Capital’s Economic Gauges

Market Moves: Charting Our Strategies, September 2020

Clark Capital’s Bottom-Up, Fundamental Strategies

Equity markets took a breather in September as the decline in daily new COVID cases reversed, bringing into question the sustainability and speed of the economic recovery from the sharp spring recession. Both election uncertainty and a delay in Congress’s ability to provide an additional COVID stimulus package also weighed on markets. Although COVID cases are rising, the economy continues to reopen which benefits value oriented, cyclical industries such as Transports and Materials.

Despite the September market decline, growth stocks continue to outperform value by a wide margin for the year. Any rally in value stocks has been short lived, with the worst laggards found in the hard-hit bank, Energy and travel and leisure stocks.

In September, the High Dividend Equity portfolio purchased a construction machinery and equipment company and increased its position in a transportation company. From a macro perspective, both of those companies are benefactors of the economic re-opening theme. In All Cap, Technology and Consumer Discretionary remain its largest sector weights.

In fixed income, the 10-year U.S. Treasury yield remained steady during the month around 0.70% while junk credit spreads widened in sympathy with the increase in daily COVID cases. Heavy new issue supply in both investment grade and high yield corporate debt kept dealers busy pricing and placing bonds. The Taxable Fixed Income portfolio continues to reinvest proceeds from bond that are being called.

Below are strategy updates from September:

All Cap Core U.S. Equity

- The Navigator® All Cap portfolio is comprised of approximately 67.5% in large-cap stocks and the remainder in mid/small-cap stocks and cash.

- The portfolio continues to balance holdings and adjustments between those companies which we believe will benefit from work-from-home trends and the those which will benefit from economic re-opening.

- Technology remains the largest sector weight in the strategy at 23.2%. Consumer Discretionary, Financials and Healthcare are our next biggest sector exposures each with weightings between 12.2% and 17.1%.

High Dividend Equity

- In September, we purchased a manufacturer of construction and mining machinery as well as engines and turbines as we believe there are multiple tailwinds for this stock entering the fourth quarter and into 2021.

- Over the month, we increased our position in a transportation company. Other position increases included adding to our multi-year holding in a communications company, a medical devices company, a worldwide investment and a renewable-energy infrastructure company with double digit dividend growth.

- Portfolio reductions during the month included an apartment REIT and a waste management company.

- The portfolio sold out of a position in an oil company to further emphasize our Energy underweight as global oversupply of oil and low prices continue to plague the industry. In addition, the portfolio sold out of a Healthcare company and life insurance company.

- Top contributing sectors for September were Energy, Healthcare and Real Estate while underperforming sectors included Technology, Industrials and Materials.

International Equity ADR

- Navigator® ADR/International Equity is positioned with approximately 17.4% invested in emerging markets with the balance in developed economies.

- Our weight in Japan has been reduced to 11.5% from about 20% at the height of the pandemic, which included exiting a Japanese telephone company as pressure mounts to reduce subscriber fees.

- During the month, the portfolio added a Canadian trucking company, and a building materials as economic prospects, mobility and home investment trends improve.

- The portfolio exited positions in a Chinese discount retailer, a financial company, and a Canadian bank during the month as either business momentum slowed or credit conditions remain a concern.

- Financials and Technology remain our largest sector weights with Japan, Switzerland, Britain, and Canada our largest country weights. While U.S. security selection has been concentrated in the large cap growth area this year, performance is broadening internationally.

Small Cap Core U.S. Equity

- 72.6% of the Navigator® Small Cap portfolio in small-cap stocks with balance in mid-cap stocks and cash.

- Industrials are now the largest sector weight in the portfolio as economic conditions continue to improve. Consumer Discretionary, Healthcare and Technology represent our next largest sector weights, each greater than 15%.

- Our Technology position increased during the month with the addition of an analytics company. We removed an energy company as carbon-based energy conditions continue to deteriorate.

- We also replaced our more defensive Healthcare companies to upgrade relative out-year earnings growth prospects.

SMID Cap Core U.S. Equity

- 63.3% of the Navigator® SMID Cap portfolio is positioned in small-cap stocks with the balance in mid-cap stocks and cash.

- Industrials are now the largest sector weight in the portfolio as economic conditions continue to improve. Consumer Discretionary, Technology, Healthcare, and Financials represent our next largest sector weights, each greater than 13%.

- Our Technology position increased during the month with the addition of an analytics company. We removed an energy company as carbon-based energy conditions continue to deteriorate.

- We also replaced our more defensive Healthcare companies to upgrade relative out-year earnings growth prospects.

Taxable Fixed Income

- September started strongly for the Bloomberg Barclays US Aggregate Bond Index. After the first 3 days of trading in September the index was up 51 basis points. The rest of the month saw returns grind lower and the index closed down -5 basis points for the month. The Bloomberg Barclays Intermediate Corporate Total Return Index was also down -18 basis points.

- September continued to see some of our bonds get called as corporations looked to lock in lower longer-term rates.

- Over the month we added to our position in Technology, added a new position in Consumer Discretionary that will benefit from a robust housing as well as a REIT.

- By month’s end, we found some relative value in big banks and added to our holdings in that sector.

Tax-Free Fixed Income

- The Bloomberg Barclays Municipal Bond 5-year Total Return Index notched a very modest 0.17% gain for the month. Municipal yields were virtually unchanged over the period; the curve 3 years to 30 years was 3 basis points steeper.

- The “hidden supply” of customer bids wanted is in a growing phase, with notional volume exceeding $700 million a day. Considering seasonal bid wanted patterns, we believe that the fourth quarter poses challenges in that annual high spikes most often occur in October and November, a period when new issue supply generally balloons as well.

- While autumn is usually a challenge for munis until the seasonal influx of cash arrives in December and January, considering that recently nearly 30% of new issue has been taxable, supply shocks may be manageable.

- Also helping the cause are states like NJ, which is raising top tax brackets to 10.75%, adding to the value of the exemption on municipals and perhaps justifying the low nominal rates we are experiencing.

Clark Capital’s Top-Down, Quantitative Strategies

The markets endured a correction in September following a run into record territory, giving back a small portion of the massive gain from the March lows. The good news is that the uptrend remains intact, the correction has relieved some pressure driven by too optimistic investor sentiment, and we are beginning to see some of the economic re-opening themes perform well, including basic materials, cyclicals, and industrials.

Through the first nine months of the year, large-cap and large-cap growth themes have been clear winners, while value has lagged significantly. The performance spread between large-cap growth and large-cap value is an eye-popping 35.91%.

The Style Opportunity portfolio remains primarily invested in large-caps, with a focus on growth given its persistently strong relative strength. A small tweak to the portfolio was made during the month by adding momentum and trimming large-cap growth exposure. The Global Tactical portfolio is fully invested in equities, having shifted its exposure from risk-off in U.S. Treasuries into a risk-on position on July 30th as the strategy’s risk management models turned bullish. The portfolio held up relatively well during the month even as the markets corrected.

International markets, which have not rebounded as strongly as the U.S., held up better during the recent weakness. Fixed Income Total Return remains invested in high yield. The high yield market did have a correction in September, as did other risk-on asset classes. During that corrective period, credit remain well supported and there was little evidence of a flight to safety with U.S. Treasury yields remaining flat.

Below are strategy updates from September:

Alternative

- Our Alternative Opportunity portfolio benefited from a good deal of diversification during the recent market correction with a mix of market neutral, managed futures, commodity, currency, equity, and fixed income allocations.

- Recent moves include reducing market neutral exposure and event driven arbitrage and incrementally adding to its exposures in managed futures.

- In addition, the strategy maintains a small U.S. Dollar position as a hedge against commodity weakness.

Fixed Income Total Return

- Fixed Income Total Return moved back into high yield on July 30th and since then, the models have remained strong and the strategy remains invested in high yield.

- The high yield market did have a correction in September, as did other risk-on asset classes. The Bloomberg Barclays U.S. Corporate High Yield Index declined 1.99% from its peak on 9/2/20 to its recent low on 9/25/20.

- During that corrective period, credit remain well supported and there was little evidence of a flight to safety with U.S. Treasury yields remaining flat.

Style Opportunity

- The Style Opportunity portfolio remains primarily invested in large caps, with a focus on growth given its persistently strong relative strength.

- A small tweak to the portfolio was made during the month by adding momentum and trimming large-cap growth exposure.

- Overall, the portfolio is allocated 98% in large-caps between the S&P 500, large-cap growth and momentum.

- Value and smaller market caps continue to lag in our relative strength models.

The S&P 500 Index is a stock market index that tracks the stocks of 500 large-cap U.S. companies.

Fixed income securities are subject to certain risks including, but not limited to: interest rate (changes in interest rates may cause a decline in market value of an investment), credit, payment, call (some bonds allow the issuer to call a bond for redemption before it matures), and extension (principal repayments may not occur as quickly as anticipated, causing the expected maturity of a security to increase).

Foreign securities are more volatile, harder to price and less liquid than U.S. securities. They are subject to different accounting and regulatory standards and political and economic risks. These risks are enhanced in emerging market countries.

Municipal securities can be affected by adverse tax, legislative or political changes and the financial conditions of the issuers of the municipal securities.

Municipal bonds can be significantly affected by political and economic changes, including inflation, as well as uncertainties in the municipal market related to taxation, legislative changes, or the rights or municipal security holders. Municipal bonds have varying levels of sensitivity to changes in interest rates. Interest rate risk is generally lower for shorter-term municipal bonds and higher for long term municipal bonds.

The trade-weighted dollar is an index created by the FED to measure the value of the USD, based on its competitiveness versus trading partners. A trade-weighted dollar is a measurement of the foreign exchange value of the U.S. dollar compared against certain foreign currencies.

The Bloomberg Barclays US Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, US dollar-denominated, fixed-rate taxable bond market. The index includes Treasuries, government-related and corporate securities, MBS (agency fixed-rate pass-throughs), ABS and CMBS (agency and non-agency).

The Bloomberg Barclays US Intermediate Corporate Bond Index measures the investment grade, fixed-rate, taxable corporate bond market. It includes USD-denominated securities publicly issued by US and non-US industrial, utility and financial issuers that have between 1 and up to, but not including, 10 years to maturity.

The Bloomberg Barclays Municipal Bond 5-year Total Return Index covers the USD-denominated long-term tax exempt bond market.

The Bloomberg Barclays US Corporate High Yield Bond Index measures the USD-denominated, high yield, fixed-rate corporate bond market.

This document may contain certain information that constitutes forward-looking statements which can be identified by the use of forward-looking terminology such as “may,” “expect,” “will,” “hope,” “forecast,” “intend,” “target,” “believe,” and/or comparable terminology (or the negative thereof). Forward looking statements cannot be guaranteed. No assurance, representation, or warranty is made by any person that any of Clark Capital’s assumptions, expectations, objectives, and/or goals will be achieved. Nothing contained in this document may be relied upon as a guarantee, promise, assurance, or representation as to the future.

Clark Capital Management Group, Inc. is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training. More information about Clark Capital’s advisory services and fees can be found in its Form ADV which is available upon request. CCM-1188