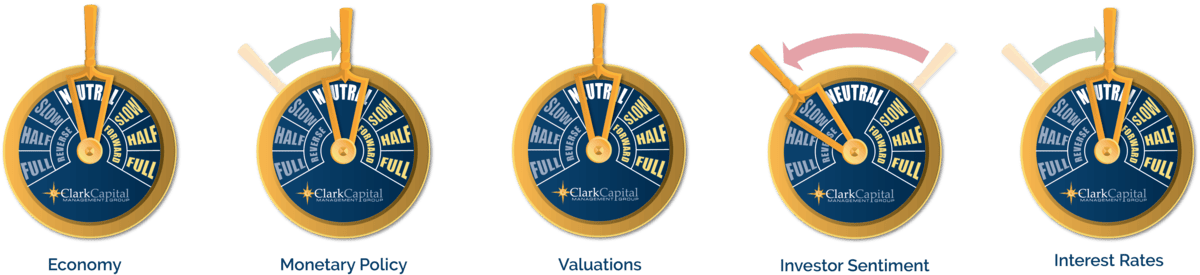

Clark Capital’s Economic Gauges

Monthly Moves: Charting Our Strategies, January 2024

Clark Capital’s Bottom-Up, Fundamental Strategies

The S&P 500 Index hit several record highs driven by continued strength from Technology, Healthcare, Financials, and Consumer Staples companies. Factors that contributed the most to performance included momentum, liquidity, and profitability.

Strong Q4 2023 economic growth dampened optimism that the Fed would begin cutting rates as soon as March. Mindful of their dual mandates, the Fed cooled investor sentiment at month end, essentially bringing into question the speed with which they will begin to initiate easing policy from their current neutral bias.

Below are strategy updates from January:

Navigator® All Cap Core U.S. Equity

- The Navigator® All Cap Equity strategy is positioned with approximately 72.8% in large-cap stocks and the remainder in mid/small-cap companies and cash.

- Albeit underweight to the benchmark, Information Technology remains the largest sector weight in the strategy at 25.4%.

- The most recent addition to the portfolio was an electronic component manufacturing company. The most recent exit was a telecommunications company.

High Dividend Equity

- Navigator® High Dividend Equity is positioned with approximately 98.7% in developed countries with the remainder in cash.

- The United States is the largest country weight at 90.6%, followed by Britain at 2.7% and Ireland at 2.6%. 91.7% of the portfolio is positioned in large-cap, 7.0% is positioned in mid-cap, and the remainder is positioned in cash.

- Financials are the largest sector weight at 22.1%, which is slightly below the benchmark weight of 22.3%. The next three largest portfolio weights are Healthcare, Industrials, and Information Technology at 14.5%, 14.1%, and 10.7%, respectively.

- During the month, the portfolio increased existing defensive positions in a pharmaceutical company, a multinational consumer goods corporation, a multinational tobacco company, and a health insurance company. We reduced our positions in a communications company, an electrical solutions company, and a home construction company.

Navigator® International Equity ADR

- Navigator® International Equity/ADR is positioned with 15.4% in emerging markets with a balance in developed economies and cash. Britain, China, France, Ireland, and Japan are the strategy’s largest country weights, all ranging between 6% and 17%.

- ADR’s exposure to China is now ~7.6% and is above its weighting in the MSCI All-Country World less US benchmark.

- The most recent additions to the portfolio were a Chinese manufacturing company and an Israeli technology company specializing in customer relations management software. The most recent exit was a Dutch semiconductor designer and manufacturer.

- Communication Services, Consumer Discretionary, Financials, Industrials, and Information Technology were the portfolio’s largest sector weights.

Taxable Fixed Income

- Within the portfolio, the shift towards 5-year bonds continued throughout the month.

- Banks saw the difference in spread between their 5-year and 10-year bonds hit their lowest levels in two years. The lack of compensation for the added duration risk drove the buying in the 5-year part of the curve.

- One example is a Bank holding where we sold the 10-year bond and purchased the 5-year bond. While this reduced yield slightly, the difference in spread was more than 1.5 standard deviations cheaper to where it historically trades. We would expect a mean reversion as the curve normalizes this year.

- Other trades involved buying a new issue that came at a 3-5 basis point discount to existing bonds. During the month, we purchased a Bank holding at a spread discount even with the additional demand. Spreads subsequently tightened to 10-15 basis points during the month.

- As yield curves remain inverted and spread curves are historically flat, we will continue to look for these types of trades that will take advantage of this market and the inefficiencies in it.

Tax-Free Fixed Income

- Higher yields and favorable credit news brought renewed interest to the asset class. Flows, as reported by ICI, turned the corner in January, with $3.7bn being deposited into the complex.

- The portfolio’s focus remains on income maximization and credit quality.

- Though muni credit is still enjoying favorable tailwinds, the volatility of election years as well as the increasing murmurs of regional budget deficits merit extra vigilance.

- The muni curve remains inverted in the front end, lending a bias towards shorter duration. We believe a measured pace in reinvesting according to benchmark duration will be beneficial should we experience a normalization of the yield curve.

Clark Capital’s Top-Down, Quantitative Strategies

After a very strong 2023, the markets picked up where they left off with the New Year bringing further gains and continued momentum of risk assets. Large-cap stocks fared the best, with the S&P 500 gaining 1.68% in January and finally making a new all-time closing high on 1/19/24.

Returns were very mixed, however; large-cap growth’s dominance continued with the Russell 1000 Growth Index gaining 2.49% in January while large-cap value was flat. The Russell 2000 Index of small-cap stocks lost 3.89%. We believe credit remains firm and well bid with a solid economic backdrop.

Below are strategy updates from January:

Alternative

- The portfolio has been reducing equities on the margin, building up an over 13% position in cash equivalents.

- Alternative credit, options-based, and long/short equity drove mutual fund core returns, while managed futures continued to be a drag.

- We recently added small positions in short 20-year+ Treasuries and server farms.

Fixed Income Total Return (MultiStrategy Fixed Income)

- High yield performed well in January, outperforming the Aggregate Index and U.S. Treasuries by about 1%.

- Our models indicate that underlying credit fundamentals are strong, and market concerns over the number of rate cuts are unlikely to alter our risk-on allocation.

Global Risk Management

- A strong corporate bond market backdrop and falling spreads have kept our credit models bullish since November. As a result, we believe our intermediate-term position in equities is stable.

- Domestic stocks and large-cap Technology companies led performance in January while U.S. small-caps and international equities lagged. This was largely attributed to rising U.S. interest rates and a stronger dollar.

- Despite a recent move up in interest rates, U.S. Treasuries would be our defensive vehicle of choice if markets begin to falter. However, a strong technical, economic, and monetary backdrop appears to provide markets with a solid floor.

Global Tactical

- Our credit-based models indicate a strong, stable credit backdrop that should reward risk-taking in equities.

- Similar to most of 2023, the S&P 500 and its mega-cap Technology names dominated January and were up 2% while U.S. small-caps and international equities declined.

- Our models indicate our position in equities should withstand any overdue corrective activity.

Sector Opportunity

- Not surprisingly, the portfolio is mostly positioned in Technology.

- Homebuilders and Banks are the portfolio’s other holdings, with Energy, Staples, Utilities, and Healthcare to be avoided.

Style Opportunity (MultiStrategy Equity)

- Small-caps and mid-caps surged in November and January, but gave back considerable relative ground in January.

- Large-cap growth’s market dominance returned, and our portfolio has moved to reflect that, allocating 55% to large-cap growth.

- The remainder of the portfolio is split between the S&P 500 and small-caps, which we believe are fading.

U.S. Strategic Beta

- The portfolio is neutral regarding value vs. growth, but would likely add to growth whenever it undergoes an overdue relative correction.

- Small-caps and mid-caps remain modest overweights as we believe their valuations make them attractive in the long term.

The opinions referenced are as of the date of publication and are subject to change due to changes in the market or economic conditions and may not necessarily come to pass. There is no guarantee of the future performance of any Clark Capital investments portfolio. Material presented has been derived from sources considered to be reliable, but the accuracy and completeness cannot be guaranteed. Nothing herein should be construed as a solicitation, recommendation or an offer to buy, sell or hold any securities, other investments or to adopt any investment strategy or strategies. For educational use only. This information is not intended to serve as investment advice. This material is not intended to be relied upon as a forecast or research. The investment or strategy discussed may not be suitable for all investors. Investors must make their own decisions based on their specific investment objectives and financial circumstances. Past performance does not guarantee future results.

Fixed income securities are subject to certain risks including, but not limited to: interest rate (changes in interest rates may cause a decline in market value of an investment), credit, payment, call (some bonds allow the issuer to call a bond for redemption before it matures), and extension (principal repayments may not occur as quickly as anticipated, causing the expected maturity of a security to increase).

Foreign securities are more volatile, harder to price and less liquid than U.S. securities. They are subject to different accounting and regulatory standards and political and economic risks. These risks are enhanced in emerging market countries.

The MSCI ACWI ex USA Index captures large and mid cap representation across 22 of 23 Developed Markets (DM) countries (excluding the US) and 26 Emerging Markets (EM) countries*. With 2,206 constituents, the index covers approximately 85% of the global equity opportunity set outside the US.

The Bloomberg US Corporate High Yield Bond Index measures the USD-denominated, high yield, fixed-rate corporate bond market.

The Bloomberg Barclays 7-10 Year Index measures the performance of the U.S. Government bond market and includes public obligations of the U.S. Treasury with a maturity of between seven and up to (but not including) ten years.

The Russell 2000 Index is a small-cap stock market index that represents the bottom 2,000 stocks in the Russell 3000.

The Russell 2000 Value Index measures the performance of the small-cap value segment of the U.S. equity universe. It includes those Russell 2000 companies with lower price-to-book ratios and lower expected and historical growth values.

The Russell 2000 Growth Index measures the performance of the small-cap growth segment of the U.S. equity universe.

The 2 Year Treasury Rate is the yield received for investing in a US government issued treasury security that has a maturity of 2 years. The 2 year treasury yield is included on the shorter end of the yield curve and is important when looking at the overall US economy.

The 10 Year Treasury Rate is the yield received for investing in a US government issued treasury security that has a maturity of 10 year. The 10 year treasury yield is included on the longer end of the yield curve. Many analysts will use the 10 year yield as the “risk free” rate when valuing the markets or an individual security.

A municipal bond is a debt security issued by a state, municipality, or county to finance its capital expenditures, including the construction of highways, bridges, or schools. They can be thought of as loans that investors make to local governments.

The S&P 500 measures the performance of the 500 leading companies in leading industries of the U.S. economy, capturing 75% of U.S. equities.

Non-investment-grade debt securities (high-yield/junk bonds) may be subject to greater market fluctuations, risk of default or loss of income and principal than higher-rated securities.

The securities of mid-cap companies may be subject to more abrupt or erratic market movements and may have lower trading volumes.

This document may contain certain information that constitutes forward-looking statements which can be identified by the use of forward-looking terminology such as “may,” “expect,” “will,” “hope,” “forecast,” “intend,” “target,” “believe,” and/or comparable terminology (or the negative thereof). Forward looking statements cannot be guaranteed. No assurance, representation, or warranty is made by any person that any of Clark Capital’s assumptions, expectations, objectives, and/or goals will be achieved. Nothing contained in this document may be relied upon as a guarantee, promise, assurance, or representation as to the future.

Clark Capital Management Group, Inc. is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training. More information about Clark Capital’s advisory services and fees can be found in its Form ADV which is available upon request. CCM-1188